Page 13 - Marcus & Millichap EE Guide 2020

P. 13

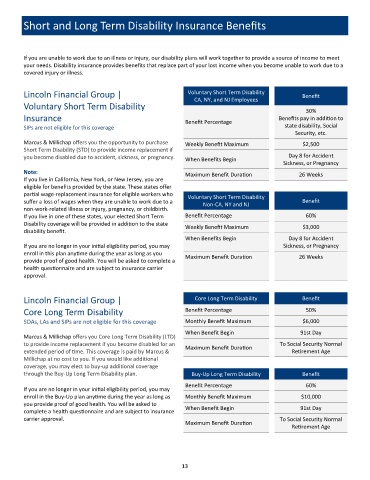

Short and Long Term Disability Insurance Benefits

If you are unable to work due to an illness or injury, our disability plans will work together to provide a source of income to meet

your needs. Disability insurance provides benefits that replace part of your lost income when you become unable to work due to a

covered injury or illness.

Lincoln Financial Group | Voluntary Short Term Disability Benefit

CA, NY, and NJ Employees

Voluntary Short Term Disability

30%

Insurance Benefits pay in addition to

Benefit Percentage

SIPs are not eligible for this coverage state disability, Social

Security, etc.

Marcus & Millichap offers you the opportunity to purchase Weekly Benefit Maximum $2,500

Short Term Disability (STD) to provide income replacement if

you become disabled due to accident, sickness, or pregnancy. Day 8 for Accident

When Benefits Begin

Sickness, or Pregnancy

Note:

Maximum Benefit Duration 26 Weeks

If you live in California, New York, or New Jersey, you are

eligible for benefits provided by the state. These states offer

partial wage-replacement insurance for eligible workers who Voluntary Short Term Disability

suffer a loss of wages when they are unable to work due to a Non-CA, NY and NJ Benefit

non-work-related illness or injury, pregnancy, or childbirth.

If you live in one of these states, your elected Short Term Benefit Percentage 60%

Disability coverage will be provided in addition to the state Weekly Benefit Maximum $3,000

disability benefit.

When Benefits Begin Day 8 for Accident

If you are no longer in your initial eligibility period, you may Sickness, or Pregnancy

enroll in this plan anytime during the year as long as you Maximum Benefit Duration 26 Weeks

provide proof of good health. You will be asked to complete a

health questionnaire and are subject to insurance carrier

approval.

Lincoln Financial Group | Core Long Term Disability Benefit

Core Long Term Disability Benefit Percentage 50%

SOAs, LAs and SIPs are not eligible for this coverage Monthly Benefit Maximum $6,000

When Benefit Begin 91st Day

Marcus & Millichap offers you Core Long Term Disability (LTD)

to provide income replacement if you become disabled for an Maximum Benefit Duration To Social Security Normal

extended period of time. This coverage is paid by Marcus & Retirement Age

Millichap at no cost to you. If you would like additional

coverage, you may elect to buy-up additional coverage

through the Buy-Up Long Term Disability plan. Buy-Up Long Term Disability Benefit

Benefit Percentage 60%

If you are no longer in your initial eligibility period, you may

enroll in the Buy-Up plan anytime during the year as long as Monthly Benefit Maximum $10,000

you provide proof of good health. You will be asked to

complete a health questionnaire and are subject to insurance When Benefit Begin 91st Day

carrier approval. To Social Security Normal

Maximum Benefit Duration

TERM DISABILITY BENEFIT Retirement Age

13