Page 15 - Marcus & Millichap EE Guide 2020

P. 15

Supplemental Insurance

SIPs are not eligible for this coverage

You may purchase individual policies from MetLife. Your premiums are paid through payroll deductions on an after-tax basis.

MetLife policies offer direct-to-the-policyholder cash payouts to help cover what other insurance doesn’t. Policies are portable,

which means that you can keep them should you change jobs or retire, with no increase in premiums. There are no pre-existing

condition limitations on these plans.

MetLife | Accident

MetLife Accident insurance provides a financial cushion for life’s unexpected events. It provides you and your covered family

members a lump-sum payment to help cover your out-of-pocket medical costs or your family’s everyday living expenses in case of

an accidental injury. For covered accidental injuries, payments are made directly to you, regardless of any other coverage. Benefits

are paid according to a fixed schedule that includes medical services and over 150 different covered events, such as: fractures,

dislocations, concussions, burns, lacerations, physical and occupational therapy and more. For example, if you had an emergency

room visit, MetLife would pay you $150! Health Benefit Screening: MetLife’s Accident policy will provide a $50 wellness benefit per

person each year for completing certain annual preventative screenings/lab work.

MetLife | Hospital Indemnity

Hospital Indemnity insurance coverage provides you with payments when you are admitted for 24 hours or more, and per day

when you are confined to a hospital, due to a covered accident or illness. Your plan will pay $500 for an admission, and a daily

amount of $100 per day, up to 15 days. Hospital Indemnity also pays extra benefits for admission to and/or confinement in an

Intensive Care Unit (ICU), and for other benefits and services.

MetLife | Critical Illness

MetLife Critical Illness insurance can help you protect yourself, your family and your budget from the financial impact of a serious

medical condition. You will receive a lump-sum cash payment upon diagnosis of a covered condition such as a Heart Attack, Stroke,

Kidney Failure and Cancer. You may elect $10,000 or $20,000, and your spouse and dependents can elect up to 100% of your

coverage amount, with no medical questions.

Health Benefit Screening: MetLife’s Critical Illness policy will provide a $50 wellness benefit per person each year for completing

certain annual preventative screenings/lab work, as well as $200 each year for completing a mammogram.

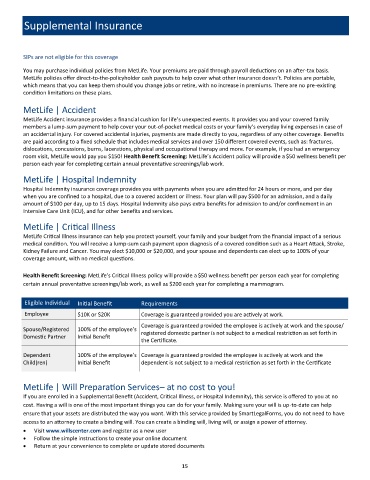

Eligible Individual Initial Benefit Requirements

Employee $10K or $20K Coverage is guaranteed provided you are actively at work.

Coverage is guaranteed provided the employee is actively at work and the spouse/

Spouse/Registered 100% of the employee’s registered domestic partner is not subject to a medical restriction as set forth in

Domestic Partner Initial Benefit

the Certificate.

Dependent 100% of the employee’s Coverage is guaranteed provided the employee is actively at work and the

Child(ren) Initial Benefit dependent is not subject to a medical restriction as set forth in the Certificate

MetLife | Will Preparation Services– at no cost to you!

If you are enrolled in a Supplemental Benefit (Accident, Critical Illness, or Hospital Indemnity), this service is offered to you at no

cost. Having a will is one of the most important things you can do for your family. Making sure your will is up-to-date can help

ensure that your assets are distributed the way you want. With this service provided by SmartLegalForms, you do not need to have

access to an attorney to create a binding will. You can create a binding will, living will, or assign a power of attorney.

• Visit www.willscenter.com and register as a new user

• Follow the simple instructions to create your online document

• Return at your convenience to complete or update stored documents

15