Page 4 - HM Benefits Guide 2019 CA

P. 4

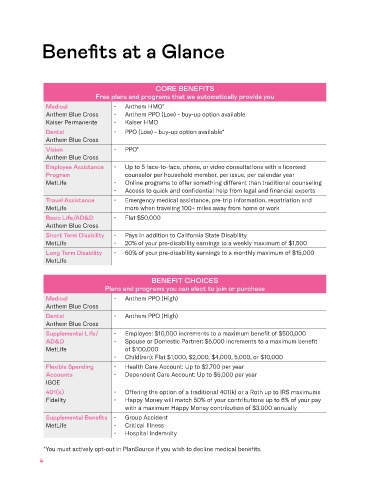

Benefits at a Glance

CORE BENEFITS

Free plans and programs that we automatically provide you

Medical • Anthem HMO*

Anthem Blue Cross • Anthem PPO (Low) - buy-up option available

Kaiser Permanente • Kaiser HMO

Dental • PPO (Low) - buy-up option available*

Anthem Blue Cross

Vision • PPO*

Anthem Blue Cross

Employee Assistance • Up to 5 face-to-face, phone, or video consultations with a licensed

Program counselor per household member, per issue, per calendar year

MetLife • Online programs to offer something different than traditional counseling

• Access to quick and confidential help from legal and financial experts

Travel Assistance • Emergency medical assistance, pre-trip information, repatriation and

MetLife more when traveling 100+ miles away from home or work

Basic Life/AD&D • Flat $50,000

Anthem Blue Cross

Short Term Disability • Pays in addition to California State Disability

MetLife • 20% of your pre-disability earnings to a weekly maximum of $1,500

Long Term Disability • 60% of your pre-disability earnings to a monthly maximum of $15,000

MetLife

BENEFIT CHOICES

Plans and programs you can elect to join or purchase

Medical • Anthem PPO (High)

Anthem Blue Cross

Dental • Anthem PPO (High)

Anthem Blue Cross

Supplemental Life/ • Employee: $10,000 increments to a maximum benefit of $500,000

AD&D • Spouse or Domestic Partner: $5,000 increments to a maximum benefit

MetLife of $100,000

• Child(ren): Flat $1,000, $2,000, $4,000, 5,000, or $10,000

Flexible Spending • Health Care Account: Up to $2,700 per year

Accounts • Dependent Care Account: Up to $5,000 per year

IGOE

401(k) • Offering the option of a traditional 401(k) or a Roth up to IRS maximums

Fidelity • Happy Money will match 50% of your contributions up to 6% of your pay

with a maximum Happy Money contribution of $3,000 annually

Supplemental Benefits • Group Accident

MetLife • Critical Illness

• Hospital Indemnity

*You must actively opt-out in PlanSource if you wish to decline medical benefits.

4