Page 5 - HM Benefits Guide 2019 CA

P. 5

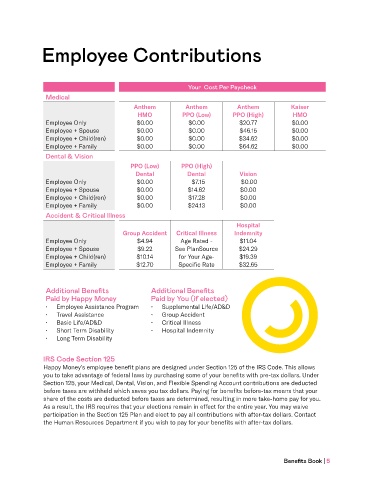

Employee Contributions

Your Cost Per Paycheck

Medical

Anthem Anthem Anthem Kaiser

HMO PPO (Low) PPO (High) HMO

Employee Only $0.00 $0.00 $20.77 $0.00

Employee + Spouse $0.00 $0.00 $46.15 $0.00

Employee + Child(ren) $0.00 $0.00 $34.62 $0.00

Employee + Family $0.00 $0.00 $64.62 $0.00

Dental & Vision

PPO (Low) PPO (High)

Dental Dental Vision

Employee Only $0.00 $7.15 $0.00

Employee + Spouse $0.00 $14.62 $0.00

Employee + Child(ren) $0.00 $17.28 $0.00

Employee + Family $0.00 $24.13 $0.00

Accident & Critical Illness

Hospital

Group Accident Critical Illness Indemnity

Employee Only $4.94 Age Rated - $11.04

Employee + Spouse $9.22 See PlanSource $24.29

Employee + Child(ren) $10.14 for Your Age- $19.39

Employee + Family $12.70 Specific Rate $32.65

Additional Benefits Additional Benefits

Paid by Happy Money Paid by You (if elected)

• Employee Assistance Program • Supplemental Life/AD&D

• Travel Assistance • Group Accident

• Basic Life/AD&D • Critical Illness

• Short Term Disability • Hospital Indemnity

• Long Term Disability

IRS Code Section 125

Happy Money’s employee benefit plans are designed under Section 125 of the IRS Code. This allows

you to take advantage of federal laws by purchasing some of your benefits with pre-tax dollars. Under

Section 125, your Medical, Dental, Vision, and Flexible Spending Account contributions are deducted

before taxes are withheld which saves you tax dollars. Paying for benefits before-tax means that your

share of the costs are deducted before taxes are determined, resulting in more take-home pay for you.

As a result, the IRS requires that your elections remain in effect for the entire year. You may waive

participation in the Section 125 Plan and elect to pay all contributions with after-tax dollars. Contact

the Human Resources Department if you wish to pay for your benefits with after-tax dollars.

Benefits Book | 5