Page 10 - MyPoint EE Guide

P. 10

BENEFITS

Disability Insurance

If you are unable to work due to an illness or injury, our disability plan will provide a source of income to meet your needs.

Disability insurance provides benefits that replace part of your lost income when you become unable to work due to a covered

injury or illness.

California State Disability (SDI)

If you experience a Short Term Disability claim, you are eligible for benefits provided by the state. California State Disability

Insurance (SDI) is a partial wage-replacement insurance plan for California workers. The SDI program is state-mandated and

funded through employee payroll deductions. SDI provides short term benefits to eligible workers who suffer a loss of wages

when they are unable to work due to a non-work-related illness or injury, pregnancy, or childbirth. For more information on

eligibility, benefit amounts, and instructions on how to file a claim for the SDI program please visit the EDD website at

www.edd.ca.gov.

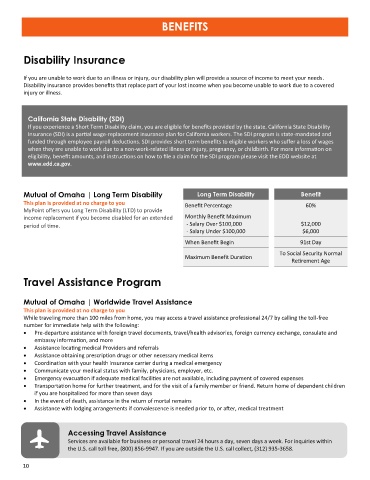

Mutual of Omaha | Long Term Disability Long Term Disability Benefit

This plan is provided at no charge to you

Benefit Percentage 60%

MyPoint offers you Long Term Disability (LTD) to provide

income replacement if you become disabled for an extended Monthly Benefit Maximum

period of time.NG TERM DISABILITY BENEFIT - Salary Over $100,000 $12,000

- Salary Under $100,000 $6,000

When Benefit Begin 91st Day

To Social Security Normal

Maximum Benefit Duration

Retirement Age

Travel Assistance Program

Mutual of Omaha | Worldwide Travel Assistance

This plan is provided at no charge to you

While traveling more than 100 miles from home, you may access a travel assistance professional 24/7 by calling the toll-free

number for immediate help with the following:

• Pre-departure assistance with foreign travel documents, travel/health advisories, foreign currency exchange, consulate and

embassy information, and more

• Assistance locating medical Providers and referrals

• Assistance obtaining prescription drugs or other necessary medical items

• Coordination with your health insurance carrier during a medical emergency

• Communicate your medical status with family, physicians, employer, etc.

• Emergency evacuation if adequate medical facilities are not available, including payment of covered expenses

• Transportation home for further treatment, and for the visit of a family member or friend. Return home of dependent children

if you are hospitalized for more than seven days

• In the event of death, assistance in the return of mortal remains

• Assistance with lodging arrangements if convalescence is needed prior to, or after, medical treatment

Accessing Travel Assistance

Services are available for business or personal travel 24 hours a day, seven days a week. For inquiries within

the U.S. call toll free, (800) 856-9947. If you are outside the U.S. call collect, (312) 935-3658.

10