Page 14 - United Capital EE Guide 04-18 PFE

P. 14

VISION INSURANCE LIFE AND AD&D INSURANCE

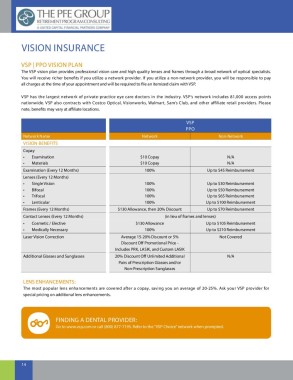

VSP | PPO VISION PLAN CIGNA | BASIC LIFE AND AD&D

The VSP vision plan provides professional vision care and high quality lenses and frames through a broad network of optical specialists. Life insurance protects your family or other beneficiaries in the event of your death while you are still actively employed with the

You will receive richer benefits if you utilize a network provider. If you utilize a non-network provider, you will be responsible to pay company. The PFE Group pays for coverage, offered through Cigna, in the amount of $50,000. If your death is due to a covered

all charges at the time of your appointment and will be required to file an itemized claim with VSP. accident or injury, your beneficiary will receive an additional amount through Accidental Death and Dismemberment (AD&D) coverage.

VSP has the largest network of private-practice eye care doctors in the industry. VSP’s network includes 81,000 access points

nationwide. VSP also contracts with Costco Optical, Visionworks, Walmart, Sam’s Club, and other affiliate retail providers. Please

note, benefits may vary at affiliate locations. SELECTING A BENEFICIARY DESIGNATION

A beneficiary is the person or entity who you designate to receive your death benefits. Choosing a beneficiary and keeping

your beneficiary up-to-date is an essential part of owning life insurance. Please remember to review your beneficiary

VSP

PPO designation as new situations arise, such as the birth or adoption of a child, marriage or divorce. You may login to Ultimate

to update your beneficiary as needed.

Network Name Network Non-Network

VISION BENEFITS

Copay

• Examination $10 Copay N/A CIGNA | VOLUNTARY LIFE AND AD&D

• Materials $10 Copay N/A In addition to the company provided Basic Life and AD&D benefits, you may elect to purchase additional Term Life and AD&D

Examination (Every 12 Months) 100% Up to $45 Reimbursement insurance at discounted group rates provided by Cigna. If elected, you pay for this coverage with after-tax dollars through convenient

payroll deductions.

Lenses (Every 12 Months)

• Single Vision 100% Up to $30 Reimbursement

• Bifocal 100% Up to $50 Reimbursement EMPLOYEE

• Trifocal 100% Up to $65 Reimbursement You may purchase coverage for yourself in increments of $10,000 up to a maximum benefit of $500,000. The minimum purchase

• Lenticular 100% Up to $100 Reimbursement amount is $20,000.

Frames (Every 12 Months) $130 Allowance, then 20% Discount Up to $70 Reimbursement SPOUSE

Contact Lenses (Every 12 Months) (in lieu of frames and lenses) If you buy coverage for yourself, you may also purchase coverage for your eligible spouse. Benefits for your spouse are available

• Cosmetic / Elective $130 Allowance Up to $105 Reimbursement in increments of $5,000 to a maximum benefit of $250,000.

• Medically Necessary 100% Up to $210 Reimbursement CHILD(REN)

Laser Vision Correction Average 15-20% Discount or 5% Not Covered If you buy coverage for yourself, you may also purchase coverage for your eligible dependent child(ren). Benefits for your child(ren)

Discount Off Promotional Price - are available in increments of $1,000 to a maximum benefit of $10,000.

Includes PRK, LASIK, and Custom LASIK

Additional Glasses and Sunglasses 20% Discount Off Unlimited Additional N/A

Pairs of Prescription Glasses and/or GUARANTEE ISSUE:

Non-Prescription Sunglasses Guarantee issue is a pre-approved amount of coverage that does not require you to provide proof of good health, and is available

to you during your initial eligibility period (upon hire). Guarantee issue is available in the following amounts:

LENS ENHANCEMENTS: z Employee = $130,000

The most popular lens enhancements are covered after a copay, saving you an average of 20-25%. Ask your VSP provider for z Spouse = $50,000

special pricing on additional lens enhancements. z Child(ren) = $10,000

If you are no longer in your initial eligibility period, you may enroll in Voluntary Life and AD&D insurance anytime during the year as

long as you provide proof of good health. To provide proof of good health, you will be asked to complete a health questionnaire

FINDING A DENTAL PROVIDER: and are subject to insurance carrier approval. Cigna may approve or decline coverage based on a review of your health history.

Go to www.vsp.com or call (800) 877-7195. Refer to the “VSP Choice” network when prompted.

14 15