Page 18 - Work Life and Benefits Booklet 2020 SS

P. 18

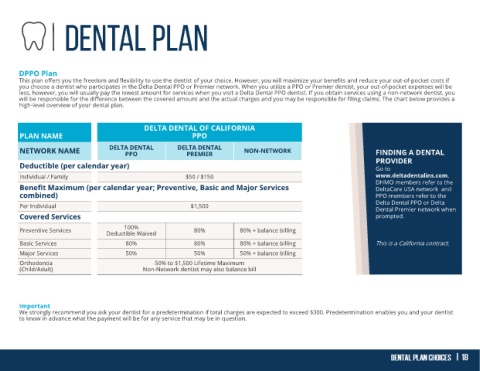

DPPO Plan

This plan offers you the freedom and flexibility to use the dentist of your choice. However, you will maximize your benefits and reduce your out-of-pocket costs if

you choose a dentist who participates in the Delta Dental PPO or Premier network. When you utilize a PPO or Premier dentist, your out-of-pocket expenses will be

less, however, you will usually pay the lowest amount for services when you visit a Delta Dental PPO dentist. If you obtain services using a non-network dentist, you

will be responsible for the difference between the covered amount and the actual charges and you may be responsible for filing claims. The chart below provides a

high-level overview of your dental plan.

DELTA DENTAL OF CALIFORNIA

PLAN NAME PPO

NETWORK NAME DELTA DENTAL DELTA DENTAL NON-NETWORK FINDING A DENTAL

PREMIER

PPO

PROVIDER

Deductible (per calendar year) Go to

Individual / Family $50 / $150 www.deltadentalins.com.

Benefit Maximum (per calendar year; Preventive, Basic and Major Services DHMO members refer to the

DeltaCare USA network and

combined) PPO members refer to the

Per Individual $1,500 Delta Dental PPO or Delta

Dental Premier network when

Covered Services prompted.

Preventive Services 100% 80% 80% + balance billing

Deductible Waived

Basic Services 80% 80% 80% + balance billing This is a California contract.

Major Services 50% 50% 50% + balance billing

Orthodontia 50% to $1,500 Lifetime Maximum

(Child/Adult) Non-Network dentist may also balance bill

Important

We strongly recommend you ask your dentist for a predetermination if total charges are expected to exceed $300. Predetermination enables you and your dentist

to know in advance what the payment will be for any service that may be in question.