Page 13 - MMI Benefit Guide 2018 FINAL

P. 13

Benefits

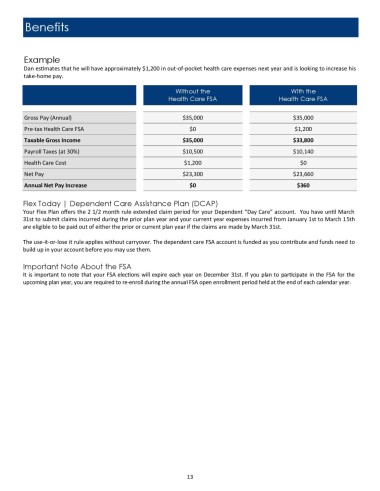

Example

Dan estimates that he will have approximately $1,200 in out-of-pocket health care expenses next year and is looking to increase his

take-home pay.

Without the With the

Health Care FSA Health Care FSA

Gross Pay (Annual) $35,000 $35,000

Pre-tax Health Care FSA $0 $1,200

Taxable Gross Income $35,000 $33,800

Payroll Taxes (at 30%) $10,500 $10,140

Health Care Cost $1,200 $0

Net Pay $23,300 $23,660

Annual Net Pay Increase $0 $360

Flex Today | Dependent Care Assistance Plan (DCAP)

Your Flex Plan offers the 2 1/2 month rule extended claim period for your Dependent “Day Care” account. You have until March

31st to submit claims incurred during the prior plan year and your current year expenses incurred from January 1st to March 15th

are eligible to be paid out of either the prior or current plan year if the claims are made by March 31st.

The use-it-or-lose it rule applies without carryover. The dependent care FSA account is funded as you contribute and funds need to

build up in your account before you may use them.

Important Note About the FSA

It is important to note that your FSA elections will expire each year on December 31st. If you plan to participate in the FSA for the

upcoming plan year, you are required to re-enroll during the annual FSA open enrollment period held at the end of each calendar year.

13