Page 28 - March 2017 Rev E_Neat

P. 28

ISSUE NUMBER 165 MARCH 2017

THE TOWN CRIER

Legislative Update

By Representative Jonathon Hill

How much more are you willing to pay for bad roads?

There is a proposal in the State House to raise gas taxes, vehicle sales taxes, and

various fees. Guess who wants it? Lawmakers, DOT, and construction industry lob-

byists—the ones who stand to profit in some way. Guess who doesn’t want it? Tax-

payers, the ones who would pay for it.

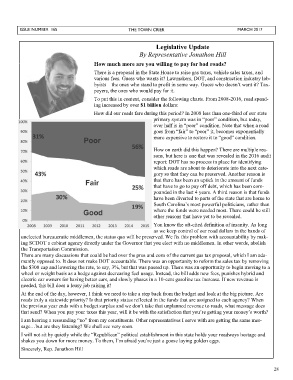

To put this in context, consider the following charts. From 2008-2016, road spend-

ing increased by over $1 billion dollars:

How did our roads fare during this period? In 2008 less than one-third of our state

primary system was in “poor” condition, but today,

over half is in “poor” condition. Note that when a road

goes from “fair” to “poor” it, becomes exponentially

more expensive to restore it to “good” condition.

How on earth did this happen? There are multiple rea-

sons, but here is one that was revealed in the 2016 audit

report: DOT has no process in place for identifying

which roads are about to deteriorate into the next cate-

gory so that they can be preserved. Another reason is

that there has been an uptick in the amount of funds

that have to go to pay off debt, which has been com-

pounded in the last 4 years. A third reason is that funds

have been diverted to parts of the state that are home to

South Carolina’s most powerful politicians, rather than

where the funds were needed most. There could be still

other reasons that have yet to be revealed.

You know the oft-cited definition of insanity. As long

as we keep control of our road dollars in the hands of

unelected bureaucratic middlemen, the status quo will be preserved. We fix this problem with accountability by mak-

ing SCDOT a cabinet agency directly under the Governor that you elect with no middlemen. In other words, abolish

the Transportation Commission.

There are many discussions that could be had over the pros and cons of the current gas tax proposal, which I am ada-

mantly opposed to. It does not make DOT accountable. There was an opportunity to reform the sales tax by removing

the $300 cap and lowering the rate, to say, 3%, but that was passed up. There was an opportunity to begin moving to a

wheel or weight basis as a hedge against decreasing fuel usage. Instead, the bill adds new fees, punishes hybrid and

electric car owners for having better cars, and slowly phases in a 10-cent gasoline tax increase. If new revenue is

needed, this bill does a lousy job raising it!

At the end of the day, however, I think we need to take a step back from the budget and look at the big picture. Are

roads truly a statewide priority? Is that priority status reflected in the funds that are assigned to each agency? When

the previous year ends with a budget surplus and we don’t take that unplanned revenue to roads, what message does

that send? When you pay your taxes this year, will it be with the satisfaction that you’re getting your money’s worth?

I am hearing a resounding “no” from my constituents. Other representatives I serve with are getting the same mes-

sage…but are they listening? We shall see very soon.

I will not sit by quietly while the “Republican” political establishment in this state holds your roadways hostage and

shakes you down for more money. To them, I’m afraid you’re just a goose laying golden eggs.

Sincerely, Rep. Jonathon Hill

28