Page 34 - Bullion World Issue 1 May 2021

P. 34

Bullion World | Issue 01 | May 2021

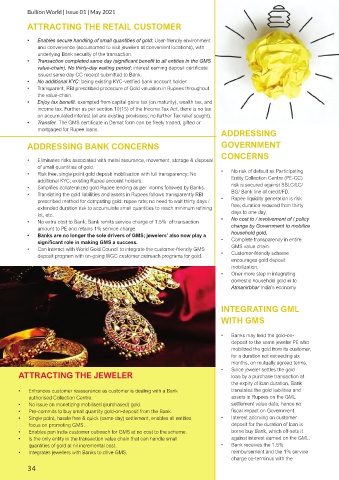

ATTRACTING THE RETAIL CUSTOMER

• Enables secure handling of small quantities of gold: User-friendly environment

and convenience (accustomed to visit jewelers at convenient locations), with

underlying Bank security of the transaction.

• Transaction completed same day (significant benefit to all entities in the GMS

value-chain). No thirty-day waiting period; interest earning deposit certificate

issued same day CC receipt submitted to Bank.

• No additional KYC: being existing KYC-verified bank account holder.

• Transparent, RBI prescribed procedure of Gold valuation in Rupees throughout

the value-chain.

• Enjoy tax benefit: exempted from capital gains tax (on maturity), wealth tax, and

income tax. Further as per section 10(15) of the Income Tax Act, there is no tax

on accumulated interest (all are existing provisions; no further Tax relief sought).

• Transfer: The GMS certificate in Demat form can be freely traded, gifted or

mortgaged for Rupee loans.

ADDRESSING

ADDRESSING BANK CONCERNS GOVERNMENT

CONCERNS

• Eliminates risks associated with metal assurance, movement, storage & disposal

of small quantities of gold.

• Risk free, single point gold deposit mobilisation with full transparency; No • No risk of default as Participating

additional KYC; existing Rupee account holders. Entity Collection Centre (PE-CC)

• Simplifies collateralized gold Rupee lending as per norms followed by Banks. risk is secured against SBLC/LC/

• Translating the gold liabilities and assets in Rupees follows transparently RBI BG/ Bank line of credit/FD.

prescribed method for computing gold: rupee rate; no need to wait thirty days / • Rupee liquidity generation is risk

extended duration risk to accumulate small quantities to reach minimum refining free; duration reduced from thirty

lot, etc. days to one day.

• No extra cost to Bank; Bank remits service charge of 1.5% of transaction • No cost to / involvement of / policy

amount to PE and retains 1% service charge. change by Government to mobilize

• Banks are no longer the sole drivers of GMS; jewelers’ also now play a household gold.

significant role in making GMS a success. • Complete transparency in entire

• Can interact with World Gold Council to integrate the customer-friendly GMS GMS value chain.

deposit program with on-going WGC customer outreach programs for gold. • Customer-friendly scheme

encourages gold deposit

mobilization.

• Oner more step in integrating

domestic household gold in to

Atmanirbhar India’s economy

INTEGRATING GML

WITH GMS

• Banks may lend the gold-on-

deposit to the same jeweler PE who

mobilized the gold from its customer,

for a duration not exceeding six

months, on mutually agreed terms.

• Since jeweler settles the gold

ATTRACTING THE JEWELER loan by a purchase transaction at

the expiry of loan duration, Bank

• Enhances customer reassurance as customer is dealing with a Bank translates the gold liabilities and

authorised Collection Centre. assets in Rupees on the GML

• No issue on monetizing mobilised (purchased) gold. settlement value date, hence no

• Pre-commits to buy small quantity gold-on-deposit from the Bank. fiscal impact on Government.

• Single point, hassle free & quick (same day) settlement, enables all entities • Interest accruing on customer

focus on promoting GMS. deposit for the duration of loan is

• Enables pan India customer outreach for GMS at no cost to the scheme. borne buy Bank, which off-sets it

• Is the only entity in the transaction value chain that can handle small against interest earned on the GML.

quantities of gold at nil incremental cost. • Bank receives the 1.5%

• Integrates jewellers with Banks to drive GMS. reimbursement and the 1% service

charge co-terminus with the

34

34