Page 54 - Bullion World Issue 1 May 2021

P. 54

Bullion World | Issue 01 | May 2021

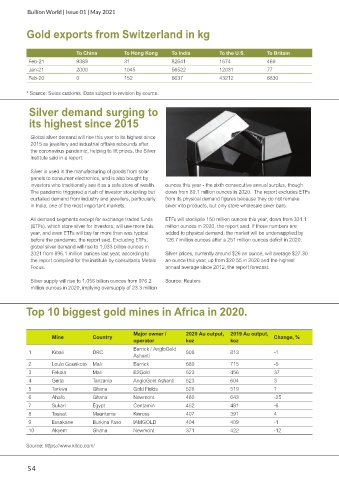

Gold exports from Switzerland in kg

To China To Hong Kong To India To the U.S. To Britain

Feb-21 9389 31 82641 1674 469

Jan-21 2000 1045 56522 12031 77

Feb-20 0 152 6637 43212 6830

* Source: Swiss customs. Data subject to revision by source.

Silver demand surging to

its highest since 2015

Global silver demand will rise this year to its highest since

2015 as jewellery and industrial offtake rebounds after

the coronavirus pandemic, helping to lift prices, the Silver

Institute said in a report.

Silver is used in the manufacturing of goods from solar

panels to consumer electronics, and is also bought by

investors who traditionally see it as a safe store of wealth. ounces this year - the sixth consecutive annual surplus, though

The pandemic triggered a rush of investor stockpiling but down from 80.1 million ounces in 2020. The report excludes ETFs

curtailed demand from industry and jewellers, particularly from its physical demand figures because they do not remake

in India, one of the most important markets. silver into products, but only store wholesale silver bars.

All demand segments except for exchange traded funds ETFs will stockpile 150 million ounces this year, down from 331.1

(ETFs), which store silver for investors, will use more this million ounces in 2020, the report said. If those numbers are

year, and even ETFs will buy far more than was typical added to physical demand, the market will be undersupplied by

before the pandemic, the report said. Excluding ETFs, 126.7 million ounces after a 251 million ounces deficit in 2020.

global silver demand will rise to 1.033 billion ounces in

2021 from 896.1 million ounces last year, according to Silver prices, currently around $26 an ounce, will average $27.30

the report compiled for the institute by consultants Metals an ounce this year, up from $20.55 in 2020 and the highest

Focus. annual average since 2012, the report forecast.

Silver supply will rise to 1.056 billion ounces from 976.2 Source: Reuters

million ounces in 2020, implying oversupply of 23.3 million

Top 10 biggest gold mines in Africa in 2020.

Major owner / 2020 Au output, 2019 Au output,

Mine Country Change, %

operator koz koz

Barrick / AngloGold

1 Kibali DRC 808 813 -1

Ashanti

2 Loulo Gounkoto Mali Barrick 680 715 -5

3 Fekola Mali B2Gold 623 456 37

4 Geita Tanzania AngloGold Ashanti 623 604 3

5 Tarkwa Ghana Gold Fields 526 519 1

6 Ahafo Ghana Newmont 480 643 -25

7 Sukari Egypt Centamin 452 481 -6

8 Tasiast Mauritania Kinross 407 391 4

9 Essakane Burkina Faso IAMGOLD 404 409 -1

10 Akyem Ghana Newmont 371 422 -12

Source: https://www.kitco.com/

54