Page 8 - Social Security - Day 1 - To Today

P. 8

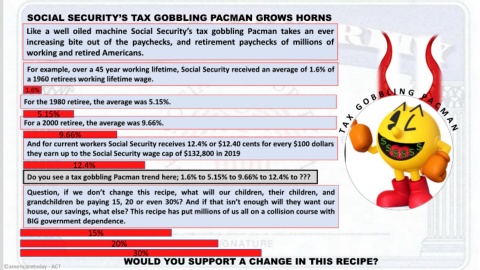

SOCIAL SECURITY’S TAX GOBBLING PACMAN GROWS HORNS

Like a well oiled machine Social Security’s tax gobbling Pacman takes an ever

increasing bite out of the paychecks, and retirement paychecks of millions of

working and retired Americans.

For example, over a 45 year working lifetime, Social Security received an average of 1.6% of

a 1960 retirees working lifetime wage.

1.6%

For the 1980 retiree, the average was 5.15%.

5.15%

For a 2000 retiree, the average was 9.66%.

9.66%

And for current workers Social Security receives 12.4% or $12.40 cents for every $100 dollars

they earn up to the Social Security wage cap of $132,800 in 2019

12.4%

Do you see a tax gobbling Pacman trend here; 1.6% to 5.15% to 9.66% to 12.4% to ???

Question, if we don’t change this recipe, what will our children, their children, and

grandchildren be paying 15, 20 or even 30%? And if that isn’t enough will they want our

house, our savings, what else? This recipe has put millions of us all on a collision course with

BIG government dependence.

15%

20%

30%

WOULD YOU SUPPORT A CHANGE IN THIS RECIPE?

f

©americaretoday - ACT