Page 9 - Social Security - Day 1 - To Today

P. 9

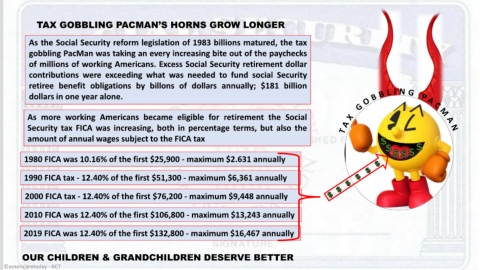

TAX GOBBLING PACMAN’S HORNS GROW LONGER

As the Social Security reform legislation of 1983 billions matured, the tax

gobbling PacMan was taking an every increasing bite out of the paychecks

of millions of working Americans. Excess Social Security retirement dollar

contributions were exceeding what was needed to fund social Security

retiree benefit obligations by billons of dollars annually; $181 billion

dollars in one year alone.

As more working Americans became eligible for retirement the Social

Security tax FICA was increasing, both in percentage terms, but also the

amount of annual wages subject to the FICA tax

1980 FICA was 10.16% of the first $25,900 - maximum $2.631 annually

1990 FICA tax - 12.40% of the first $51,300 - maximum $6,361 annually

2000 FICA tax - 12.40% of the first $76,200 - maximum $9,448 annually

2010 FICA was 12.40% of the first $106,800 - maximum $13,243 annually

2019 FICA was 12.40% of the first $132,800 - maximum $16,467 annually

OUR CHILDREN & GRANDCHILDREN DESERVE BETTER

©americaretoday - ACT