Page 13 - Social Security - Day 1 - To Today

P. 13

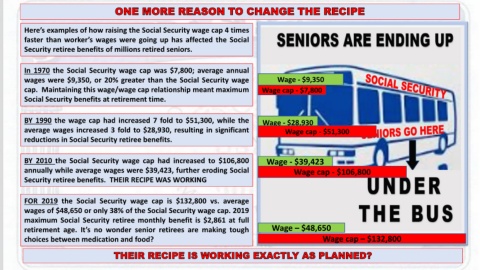

Here’s examples of how raising the Social Security wage cap 4 times

faster than worker’s wages were going up has affected the Social

Security retiree benefits of millions retired seniors.

In 1970 the Social Security wage cap was $7,800; average annual

wages were $9,350, or 20% greater than the Social Security wage Wage - $9,350

cap. Maintaining this wage/wage cap relationship meant maximum Wage cap - $7,800

Social Security benefits at retirement time.

BY 1990 the wage cap had increased 7 fold to $51,300, while the Wage - $28,930

average wages increased 3 fold to $28,930, resulting in significant Wage cap - $51,300

reductions in Social Security retiree benefits.

BY 2010 the Social Security wage cap had increased to $106,800 Wage - $39,423

annually while average wages were $39,423, further eroding Social Wage cap - $106,800

Security retiree benefits. THEIR RECIPE WAS WORKING

FOR 2019 the Social Security wage cap is $132,800 vs. average

wages of $48,650 or only 38% of the Social Security wage cap. 2019

maximum Social Security retiree monthly benefit is $2,861 at full

retirement age. It’s no wonder senior retirees are making tough Wage – $48,650

choices between medication and food? Wage cap – $132,800

©americaretoday - ACT