Page 21 - SAMOKUZI COFFEE PRODUCTION.cdr

P. 21

Samokuzi Coffee Production

Produção de Café Samokuzi

ESTUDO DE VIABILIDADE ECONÓMICO FINANCEIRA

FINANCIAL ECONOMIC VIABILITY STUDY

21 GRUPO

SAMOKUZI

samokuzi.com

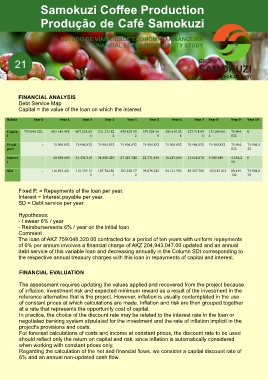

FINANCIAL ANALYSIS

Debt Service Map

Capital = the value of the loan on which the interest

Rubria Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Capita 759.048.320, 683.143.488 607.238.65 531.333.82 455.428.99 379.524.16 303.619.32 227.714.49 151.809.66 75.904. 0

l 6 4 2 0 8 6 4 832

Fixed - 75.904.832 75.904.832 75.904.832 75.904.832 75.904.832 75.904.832 75.904.832 75.904.832 75.904. 75.904.8

part 832 32

Interes - 40.988.609 36.434.319 31.880.029 27.325.740 22.771.450 18.217.160 13.662.870 9.108.580 4.554.2 0

t 90

SDt - 116.893.441 112.339.15 107.784.86 103.230.57 98.676.282 94.121.992 89.567.702 85.013.412 80.459. 75.904.8

1 1 2 122 32

Fixed P. = Repayments of the loan per year.

Interest = Interest payable per year.

SD = Debt service per year.

Hypotheses:

- I swear 6% / year

- Reimbursements 6% / year on the initial loan

Comment

The loan of AKZ 759.048.320.00 contracted for a period of ten years with uniform repayments

of 6% per annum involves a financial charge of AKZ 204,943,047.00 updated and an annual

debt service of this variable loan and decreasing annually in the Column SDt corresponding to

the respective annual treasury charges with this loan in repayments of capital and interest.

FINANCIAL EVALUATION

The assessment requires updating the values applied and recovered from the project because

of inflation, investment risk and expected minimum reward as a result of the investment in the

reference alternative that is the project. However, inflation is usually contemplated in the use

of constant prices at which calculations are made. Inflation and risk are then grouped together

at a rate that represents the opportunity cost of capital.

In practice, the choice of the discount rate may be related to the interest rate in the loan or

negotiated banking system stipulated for the investment and the rate of inflation implicit in the

project's provisions and costs.

For forecast calculations of costs and income at constant prices, the discount rate to be used

should reflect only the return on capital and risk, since inflation is automatically considered

when working with constant prices only.

Regarding the calculation of the net and financial flows, we consider a capital discount rate of

6% and an annual non-updated cash flow.