Page 25 - SAMOKUZI COFFEE PRODUCTION.cdr

P. 25

Samokuzi Coffee Production

Produção de Café Samokuzi

ESTUDO DE VIABILIDADE ECONÓMICO FINANCEIRA

FINANCIAL ECONOMIC VIABILITY STUDY

25 GRUPO

SAMOKUZI

samokuzi.com

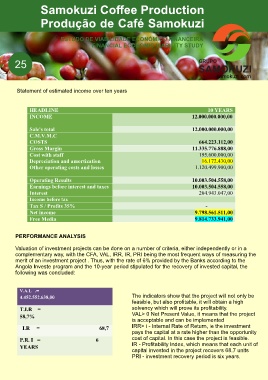

Statement of estimated income over ten years

HEADLINE 10 YEARS

INCOME 12.000.000.000,00

Sale's total 12.000.000.000,00

C.M.V.M.C

COSTS 664.223.112,00

Gross Margin 11.335.776.888,00

Cost with staff 195.600.000,00

Depreciation and amortization 16.172.430,00

Other operating costs and losses 1.120.499.900,00

Operating Results 10.003.504.558,00

Earnings before interest and taxes 10.003.504.558,00

Interest 204.943.047,00

Income before tax

Tax S / Profits 35% -

Net income 9.798.561.511,00

Free Media 9.814.733.941,00

PERFORMANCE ANALYSIS

Valuation of investment projects can be done on a number of criteria, either independently or in a

complementary way, with the CFA, VAL, IRR, IR, PRI being the most frequent ways of measuring the

merit of an investment project . Thus, with the rate of 6% provided by the Banks according to the

Angola Investe program and the 10-year period stipulated for the recovery of invested capital, the

following was concluded:

V.A.L .=

The indicators show that the project will not only be

4.452.552.638,00

feasible, but also profitable, it will obtain a high

T.I.R = solvency which will prove its profitability.

VAL> 0 Net Present Value, it means that the project

58,7%

is acceptable and can be implemented

IRR> i - Internal Rate of Return, ie the investment

I.R = 68,7

pays the capital at a rate higher than the opportunity

P.R. I = 6 cost of capital. In this case the project is feasible.

IR - Profitability Index, which means that each unit of

YEARS

capital invested in the project recovers 68.7 units

PRI - investment recovery period is six years.