Page 18 - Bullion World Issue 9 January 2022

P. 18

Bullion World | Issue 09 | January 2022

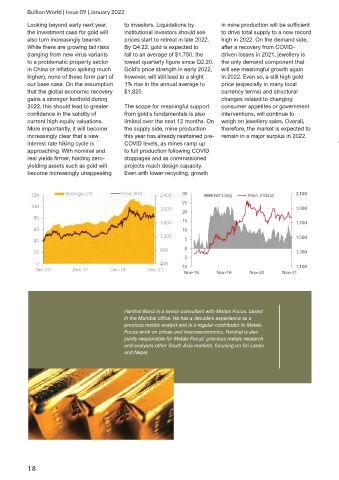

Looking beyond early next year, to investors. Liquidations by in mine production will be sufficient

the investment case for gold will institutional investors should see to drive total supply to a new record

also turn increasingly bearish. prices start to retreat in late 2022. high in 2022. On the demand side,

While there are growing tail risks By Q4.22, gold is expected to after a recovery from COVID-

(ranging from new virus variants fall to an average of $1,750, the driven losses in 2021, jewellery is

to a problematic property sector lowest quarterly figure since Q2.20. the only demand component that

in China or inflation spiking much Gold’s price strength in early 2022, will see meaningful growth again

higher), none of these form part of however, will still lead to a slight in 2022. Even so, a still high gold

our base case. On the assumption 1% rise in the annual average to price (especially in many local

that the global economic recovery $1,820. currency terms) and structural

gains a stronger foothold during changes related to changing

2022, this should lead to greater The scope for meaningful support consumer appetites or government

confidence in the solidity of from gold’s fundamentals is also interventions, will continue to

current high equity valuations. limited over the next 12 months. On weigh on jewellery sales. Overall,

More importantly, it will become the supply side, mine production therefore, the market is expected to

increasingly clear that a new this year has already reattained pre- remain in a major surplus in 2022.

interest rate hiking cycle is COVID levels, as mines ramp up

approaching. With nominal and to full production following COVID

real yields firmer, holding zero- stoppages and as commissioned

yielding assets such as gold will projects reach design capacity.

become increasingly unappealing Even with lower recycling, growth

Harshal Barot is a senior consultant with Metals Focus, based

in the Mumbai office. He has a decade’s experience as a

precious metals analyst and is a regular contributor to Metals

Focus work on prices and macroeconomics. Harshal is also

jointly responsible for Metals Focus’ precious metals research

and analyses other South Asia markets, focusing on Sri Lanka

and Nepal.

18