Page 20 - Bullion World Issue 9 January 2022

P. 20

Bullion World | Issue 09 | January 2022

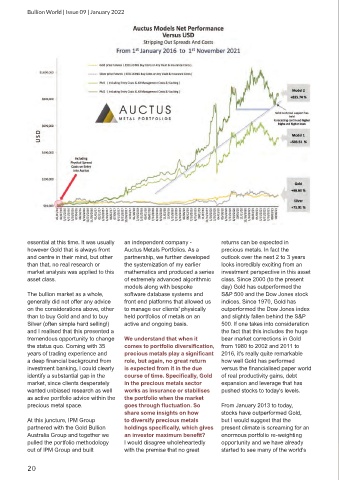

essential at this time. It was usually an independent company - returns can be expected in

however Gold that is always front Auctus Metals Portfolios. As a precious metals. In fact the

and centre in their mind, but other partnership, we further developed outlook over the next 2 to 3 years

than that, no real research or the systemization of my earlier looks incredibly exciting from an

market analysis was applied to this mathematics and produced a series investment perspective in this asset

asset class. of extremely advanced algorithmic class. Since 2000 (to the present

models along with bespoke day) Gold has outperformed the

The bullion market as a whole, software database systems and S&P 500 and the Dow Jones stock

generally did not offer any advice front end platforms that allowed us indices. Since 1970, Gold has

on the considerations above, other to manage our clients' physically outperformed the Dow Jones index

than to buy Gold and and to buy held portfolios of metals on an and slightly fallen behind the S&P

Silver (often simple hard selling!) active and ongoing basis. 500. If one takes into consideration

and I realised that this presented a the fact that this includes the huge

tremendous opportunity to change We understand that when it bear market corrections in Gold

the status quo. Coming with 35 comes to portfolio diversification, from 1980 to 2002 and 2011 to

years of trading experience and precious metals play a significant 2016, it's really quite remarkable

a deep financial background from role, but again, no great return how well Gold has performed

investment banking, I could clearly is expected from it in the due versus the financialised paper world

identify a substantial gap in the course of time. Specifically, Gold of real productivity gains, debt

market, since clients desperately in the precious metals sector expansion and leverage that has

wanted unbiased research as well works as insurance or stabilises pushed stocks to today's levels.

as active portfolio advice within the the portfolio when the market

precious metal space. goes through fluctuation. So From January 2013 to today,

share some insights on how stocks have outperformed Gold,

At this juncture, IPM Group to diversify precious metals but I would suggest that the

partnered with the Gold Bullion holdings specifically, which gives present climate is screaming for an

Australia Group and together we an investor maximum benefit? enormous portfolio re-weighting

pulled the portfolio methodology I would disagree wholeheartedly opportunity and we have already

out of IPM Group and built with the premise that no great started to see many of the world's

20