Page 291 - Data Science Algorithms in a Week

P. 291

272 Oloruntomi Joledo, Edgar Gutierrez and Hatim Bukhari

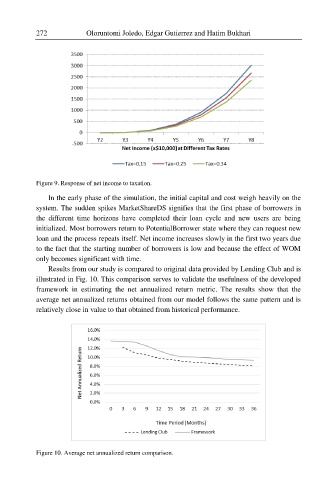

Figure 9. Response of net income to taxation.

In the early phase of the simulation, the initial capital and cost weigh heavily on the

system. The sudden spikes MarketShareDS signifies that the first phase of borrowers in

the different time horizons have completed their loan cycle and new users are being

initialized. Most borrowers return to PotentialBorrower state where they can request new

loan and the process repeats itself. Net income increases slowly in the first two years due

to the fact that the starting number of borrowers is low and because the effect of WOM

only becomes significant with time.

Results from our study is compared to original data provided by Lending Club and is

illustrated in Fig. 10. This comparison serves to validate the usefulness of the developed

framework in estimating the net annualized return metric. The results show that the

average net annualized returns obtained from our model follows the same pattern and is

relatively close in value to that obtained from historical performance.

Figure 10. Average net annualized return comparison.