Page 289 - Data Science Algorithms in a Week

P. 289

270 Oloruntomi Joledo, Edgar Gutierrez and Hatim Bukhari

ProfitMargin (an organization facing metric) is the NetIncome less inflation compared to

the total income derived from interests.

The following are some inputs used in calibrating the system dynamics model:

The initial investment by the C2C company is 500 (with all cash amounts in tens

of thousands of dollars)

The effective tax rate of the organization is 34%

All transactions accrue a 1% service charge

The simulation runs from January 1st 2012 for 8 years.

In Figure 6, the points where the ABM is coupled with the SD model are denoted by

an ABM suffix. For example, The AmmountFundedABM, InterestIncomeABM,

AmountRepaidABM are dynamic variables whose values are dependent on an update

from the ABM subsystem. The NetIncome stock represents an accumulation of the gross

income net taxes.

Results

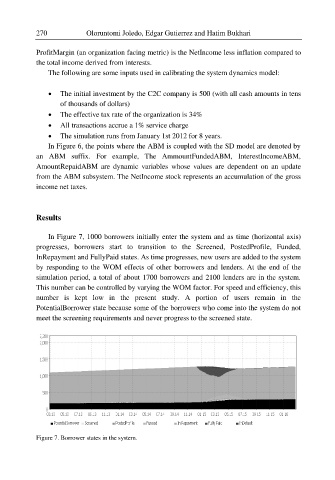

In Figure 7, 1000 borrowers initially enter the system and as time (horizontal axis)

progresses, borrowers start to transition to the Screened, PostedProfile, Funded,

InRepayment and FullyPaid states. As time progresses, new users are added to the system

by responding to the WOM effects of other borrowers and lenders. At the end of the

simulation period, a total of about 1700 borrowers and 2100 lenders are in the system.

This number can be controlled by varying the WOM factor. For speed and efficiency, this

number is kept low in the present study. A portion of users remain in the

PotentialBorrower state because some of the borrowers who come into the system do not

meet the screening requirements and never progress to the screened state.

Figure 7. Borrower states in the system.