Page 284 - Data Science Algorithms in a Week

P. 284

Agent-Based Modeling Simulation and Its Application to Ecommerce 265

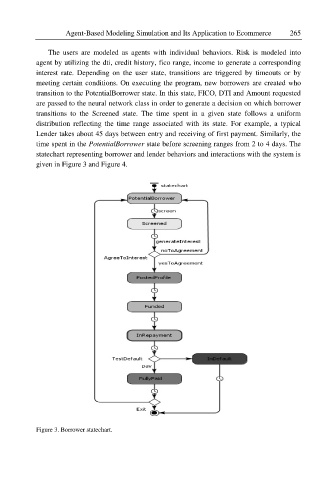

The users are modeled as agents with individual behaviors. Risk is modeled into

agent by utilizing the dti, credit history, fico range, income to generate a corresponding

interest rate. Depending on the user state, transitions are triggered by timeouts or by

meeting certain conditions. On executing the program, new borrowers are created who

transition to the PotentialBorrower state. In this state, FICO, DTI and Amount requested

are passed to the neural network class in order to generate a decision on which borrower

transitions to the Screened state. The time spent in a given state follows a uniform

distribution reflecting the time range associated with its state. For example, a typical

Lender takes about 45 days between entry and receiving of first payment. Similarly, the

time spent in the PotentialBorrower state before screening ranges from 2 to 4 days. The

statechart representing borrower and lender behaviors and interactions with the system is

given in Figure 3 and Figure 4.

Figure 3. Borrower statechart.