Page 5 - 国家税务总局广州市税务局个人所得税优惠政策一本通(2020年版)

P. 5

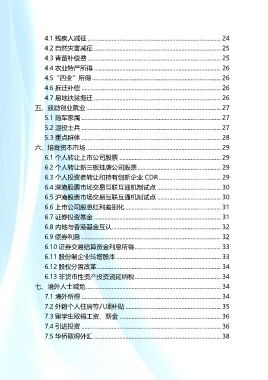

4.1 残疾人减征 ........................................................................................ 24

4.2 自然灾害减征 .................................................................................... 25

4.3 青苗补偿费 ........................................................................................ 25

4.4 农业特产所得 .................................................................................... 26

4.5“四业”所得 ..................................................................................... 26

4.6 拆迁补偿 ............................................................................................ 26

4.7 易地扶贫搬迁 .................................................................................... 26

五、鼓励创业就业 ......................................................................................... 27

5.1 随军家属 ............................................................................................ 27

5.2 退役士兵 ............................................................................................ 27

5.3 重点群体 ............................................................................................ 28

六、培育资本市场 ......................................................................................... 29

6.1 个人转让上市公司股票 ................................................................... 29

6.2 个人转让新三板挂牌公司股票 ....................................................... 29

6.3 个人投资者转让和持有创新企业 CDR ......................................... 29

6.4 深港股票市场交易互联互通机制试点 .......................................... 30

6.5 沪港股票市场交易互联互通机制试点 .......................................... 30

6.6 上市公司股息红利差别化 ............................................................... 31

6.7 证券投资基金 .................................................................................... 31

6.8 内地与香港基金互认 ........................................................................ 32

6.9 债券利息 ............................................................................................ 32

6.10 证券交易结算资金利息所得 ......................................................... 33

6.11 股份制企业转增股本 ..................................................................... 33

6.12 股权分置改革 .................................................................................. 34

6.13 非货币性资产投资递延纳税 ......................................................... 34

七、境外人士减免 ......................................................................................... 34

7.1 境外所得 ............................................................................................ 34

7.2 外籍个人住房等八项补贴 ............................................................... 35

7.3 留学生取得工资、薪金 ................................................................... 36

7.4 引进投资 ............................................................................................ 36

7.5 华侨取得外汇 .................................................................................... 38