Page 20 - The Insurance Times September 2025

P. 20

Future for Life Insurance

Nepal's Shift to Risk-

Based Capital:

Building a Resilient

Future for Life

Amit Kumar Keyal

Insurance Nepal Life Insurance Co. Ltd.

Deputy CEO

RBC is not just a compliance hurdle. Done right, it is Nepal's chance to align solvency with strategy,

efficiency with resilience, and finally separate insurers that are merely surviving from those that

are truly building for the future.

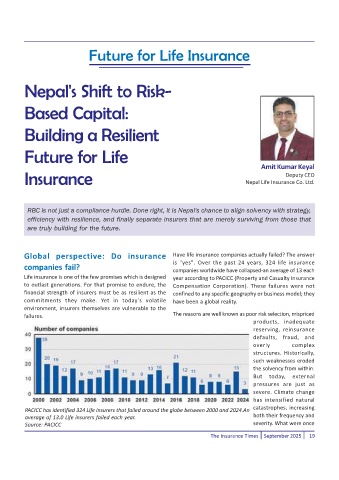

Global perspective: Do insurance Have life insurance companies actually failed? The answer

is "yes". Over the past 24 years, 324 life insurance

companies fail? companies worldwide have collapsed-an average of 13 each

Life insurance is one of the few promises which is designed year according to PACICC (Property and Casualty Insurance

to outlast generations. For that promise to endure, the Compensation Corporation). These failures were not

financial strength of insurers must be as resilient as the confined to any specific geography or business model; they

commitments they make. Yet in today's volatile have been a global reality.

environment, insurers themselves are vulnerable to the

failures. The reasons are well known as poor risk selection, mispriced

products, inadequate

reserving, reinsurance

defaults, fraud, and

overly complex

structures. Historically,

such weaknesses eroded

the solvency from within.

But today, external

pressures are just as

severe. Climate change

has intensified natural

PACICC has identified 324 Life insurers that failed around the globe between 2000 and 2024.An catastrophes, increasing

average of 13.0 Life insurers failed each year. both their frequency and

Source: PACICC severity. What were once

The Insurance Times September 2025 19