Page 45 - The Insurance Times September 2025

P. 45

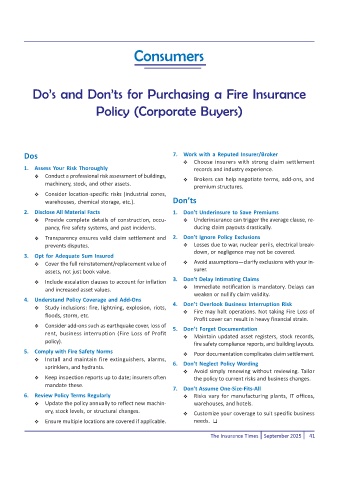

Consumers

Dos and Donts for Purchasing a Fire Insurance

Policy (Corporate Buyers)

Dos 7. Work with a Reputed Insurer/Broker

Choose insurers with strong claim settlement

1. Assess Your Risk Thoroughly records and industry experience.

Conduct a professional risk assessment of buildings,

Brokers can help negotiate terms, add-ons, and

machinery, stock, and other assets.

premium structures.

Consider location-specific risks (industrial zones,

warehouses, chemical storage, etc.). Donts

2. Disclose All Material Facts 1. Dont Underinsure to Save Premiums

Provide complete details of construction, occu- Underinsurance can trigger the average clause, re-

pancy, fire safety systems, and past incidents. ducing claim payouts drastically.

Transparency ensures valid claim settlement and 2. Dont Ignore Policy Exclusions

prevents disputes. Losses due to war, nuclear perils, electrical break-

down, or negligence may not be covered.

3. Opt for Adequate Sum Insured

Cover the full reinstatement/replacement value of Avoid assumptionsclarify exclusions with your in-

assets, not just book value. surer.

3. Dont Delay Intimating Claims

Include escalation clauses to account for inflation

Immediate notification is mandatory. Delays can

and increased asset values.

weaken or nullify claim validity.

4. Understand Policy Coverage and Add-Ons

4. Dont Overlook Business Interruption Risk

Study inclusions: fire, lightning, explosion, riots,

Fire may halt operations. Not taking Fire Loss of

floods, storm, etc.

Profit cover can result in heavy financial strain.

Consider add-ons such as earthquake cover, loss of

5. Dont Forget Documentation

rent, business interruption (Fire Loss of Profit

Maintain updated asset registers, stock records,

policy). fire safety compliance reports, and building layouts.

5. Comply with Fire Safety Norms Poor documentation complicates claim settlement.

Install and maintain fire extinguishers, alarms,

6. Dont Neglect Policy Wording

sprinklers, and hydrants.

Avoid simply renewing without reviewing. Tailor

Keep inspection reports up to date; insurers often the policy to current risks and business changes.

mandate these.

7. Dont Assume One-Size-Fits-All

6. Review Policy Terms Regularly Risks vary for manufacturing plants, IT offices,

Update the policy annually to reflect new machin- warehouses, and hotels.

ery, stock levels, or structural changes. Customize your coverage to suit specific business

Ensure multiple locations are covered if applicable. needs.

The Insurance Times September 2025 41