Page 48 - The Insurance Times September 2025

P. 48

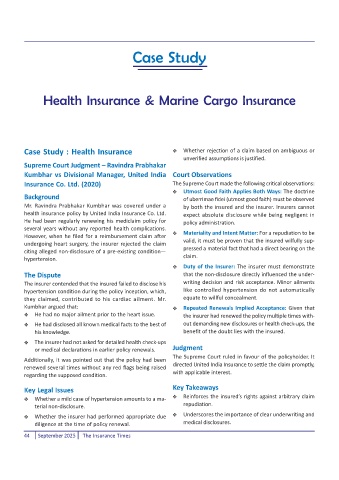

Case Study

Health Insurance & Marine Cargo Insurance

Case Study : Health Insurance Whether rejection of a claim based on ambiguous or

unverified assumptions is justified.

Supreme Court Judgment Ravindra Prabhakar

Kumbhar vs Divisional Manager, United India Court Observations

Insurance Co. Ltd. (2020) The Supreme Court made the following critical observations:

Utmost Good Faith Applies Both Ways: The doctrine

Background of uberrimae fidei (utmost good faith) must be observed

Mr. Ravindra Prabhakar Kumbhar was covered under a by both the insured and the insurer. Insurers cannot

health insurance policy by United India Insurance Co. Ltd. expect absolute disclosure while being negligent in

He had been regularly renewing his mediclaim policy for policy administration.

several years without any reported health complications.

Materiality and Intent Matter: For a repudiation to be

However, when he filed for a reimbursement claim after

valid, it must be proven that the insured wilfully sup-

undergoing heart surgery, the insurer rejected the claim

citing alleged non-disclosure of a pre-existing condition pressed a material fact that had a direct bearing on the

hypertension. claim.

Duty of the Insurer: The insurer must demonstrate

The Dispute that the non-disclosure directly influenced the under-

The insurer contended that the insured failed to disclose his writing decision and risk acceptance. Minor ailments

hypertension condition during the policy inception, which, like controlled hypertension do not automatically

they claimed, contributed to his cardiac ailment. Mr. equate to willful concealment.

Kumbhar argued that: Repeated Renewals Implied Acceptance: Given that

He had no major ailment prior to the heart issue. the insurer had renewed the policy multiple times with-

He had disclosed all known medical facts to the best of out demanding new disclosures or health check-ups, the

his knowledge. benefit of the doubt lies with the insured.

The insurer had not asked for detailed health check-ups

or medical declarations in earlier policy renewals. Judgment

The Supreme Court ruled in favour of the policyholder. It

Additionally, it was pointed out that the policy had been

directed United India Insurance to settle the claim promptly,

renewed several times without any red flags being raised

regarding the supposed condition. with applicable interest.

Key Legal Issues Key Takeaways

Reinforces the insureds rights against arbitrary claim

Whether a mild case of hypertension amounts to a ma-

terial non-disclosure. repudiation.

Whether the insurer had performed appropriate due Underscores the importance of clear underwriting and

diligence at the time of policy renewal. medical disclosures.

44 September 2025 The Insurance Times