Page 28 - Insurance Times October 2020

P. 28

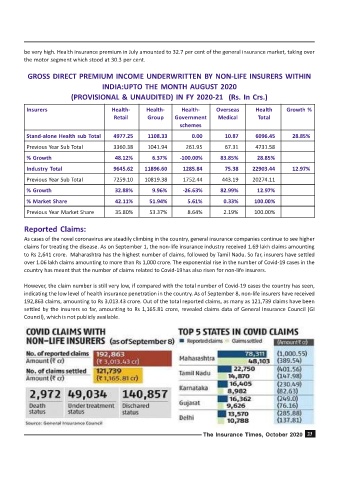

be very high. Health insurance premium in July amounted to 32.7 per cent of the general insurance market, taking over

the motor segment which stood at 30.3 per cent.

GROSS DIRECT PREMIUM INCOME UNDERWRITTEN BY NON-LIFE INSURERS WITHIN

INDIA:UPTO THE MONTH AUGUST 2020

(PROVISIONAL & UNAUDITED) IN FY 2020-21 (Rs. In Crs.)

Insurers Health- Health- Health- Overseas Health Growth %

Retail Group Government Medical Total

schemes

Stand-alone Health sub Total 4977.25 1108.33 0.00 10.87 6096.45 28.85%

Previous Year Sub Total 3360.38 1041.94 261.95 67.31 4731.58

% Growth 48.12% 6.37% -100.00% 83.85% 28.85%

Industry Total 9645.62 11896.60 1285.84 75.38 22903.44 12.97%

Previous Year Sub Total 7259.10 10819.38 1752.44 443.19 20274.11

% Growth 32.88% 9.96% -26.63% 82.99% 12.97%

% Market Share 42.11% 51.94% 5.61% 0.33% 100.00%

Previous Year Market Share 35.80% 53.37% 8.64% 2.19% 100.00%

Reported Claims:

As cases of the novel coronavirus are steadily climbing in the country, general insurance companies continue to see higher

claims for treating the disease. As on September 1, the non-life insurance industry received 1.69 lakh claims amounting

to Rs 2,641 crore. Maharashtra has the highest number of claims, followed by Tamil Nadu. So far, insurers have settled

over 1.06 lakh claims amounting to more than Rs 1,000 crore. The exponential rise in the number of Covid-19 cases in the

country has meant that the number of claims related to Covid-19has also risen for non-life insurers.

However, the claim number is still very low, if compared with the total number of Covid-19 cases the country has seen,

indicating the low level of health insurance penetration in the country. As of September 8, non-life insurers have received

192,863 claims, amounting to Rs 3,013.43 crore. Out of the total reported claims, as many as 121,739 claims have been

settled by the insurers so far, amounting to Rs 1,165.81 crore, revealed claims data of General Insurance Council (GI

Council), which is not publicly available.

The Insurance Times, October 2020