Page 56 - Banking Finance April 2022

P. 56

STATISTICS

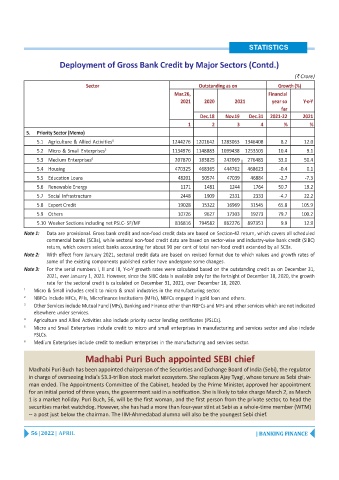

Deployment of Gross Bank Credit by Major Sectors (Contd.)

(` Crore)

Sector Outstanding as on Growth (%)

Mar.26, Financial

2021 2020 2021 year so Y-o-Y

far

Dec.18 Nov.19 Dec.31 2021-22 2021

1 2 3 4 % %

5. Priority Sector (Memo)

5.1 Agriculture & Allied Activities 4 1244276 1201642 1283063 1346408 8.2 12.0

5.2 Micro & Small Enterprises 5 1134976 1148883 1099438 1253505 10.4 9.1

5.3 Medium Enterprises 6 207870 183825 242069 276485 33.0 50.4

5.4 Housing 470325 468365 444762 468623 -0.4 0.1

5.5 Education Loans 48201 50574 47039 46884 -2.7 -7.3

5.6 Renewable Energy 1171 1481 1244 1764 50.7 19.2

5.7 Social Infrastructure 2448 1909 2331 2333 -4.7 22.2

5.8 Export Credit 19028 15322 16969 31545 65.8 105.9

5.9 Others 10726 9627 17303 19273 79.7 100.2

5.10 Weaker Sections including net PSLC- SF/MF 816816 794582 862276 897351 9.9 12.9

Note 1: Data are provisional. Gross bank credit and non-food credit data are based on Section-42 return, which covers all scheduled

commercial banks (SCBs), while sectoral non-food credit data are based on sector-wise and industry-wise bank credit (SIBC)

return, which covers select banks accounting for about 90 per cent of total non-food credit extended by all SCBs.

Note 2: With effect from January 2021, sectoral credit data are based on revised format due to which values and growth rates of

some of the existing components published earlier have undergone some changes.

Note 3: For the serial numbers I, II and III, Y-o-Y growth rates were calculated based on the outstanding credit as on December 31,

2021, over January 1, 2021. However, since the SIBC data is available only for the fortnight of December 18, 2020, the growth

rate for the sectoral credit is calculated on December 31, 2021, over December 18, 2020.

1 Micro & Small includes credit to micro & small industries in the manufacturing sector.

2 NBFCs include HFCs, PFIs, Microfinance Institutions (MFIs), NBFCs engaged in gold loan and others.

3 Other Services include Mutual Fund (MFs), Banking and Finance other than NBFCs and MFs and other services which are not indicated

elsewhere under services.

4 Agriculture and Allied Activities also include priority sector lending certificates (PSLCs).

5 Micro and Small Enterprises include credit to micro and small enterprises in manufacturing and services sector and also include

PSLCs.

6 Medium Enterprises include credit to medium enterprises in the manufacturing and services sector.

Madhabi Puri Buch appointed SEBI chief

Madhabi Puri Buch has been appointed chairperson of the Securities and Exchange Board of India (Sebi), the regulator

in charge of overseeing India's $3.3-trillion stock market ecosystem. She replaces Ajay Tyagi, whose tenure as Sebi chair-

man ended. The Appointments Committee of the Cabinet, headed by the Prime Minister, approved her appointment

for an initial period of three years, the government said in a notification. She is likely to take charge March 2, as March

1 is a market holiday. Puri Buch, 56, will be the first woman, and the first person from the private sector, to head the

securities market watchdog. However, she has had a more than four-year stint at Sebi as a whole-time member (WTM)

-- a post just below the chairman. The IIM-Ahmedabad alumna will also be the youngest Sebi chief.

56 | 2022 | APRIL | BANKING FINANCE