Page 34 - Banking Finance March 2023

P. 34

ARTICLE

Digital loan disbursal count

was at 12 times due to the

diverse influence of fintech

players and digital lending

models by the end of 2020.

Both private banks and

NBFCS 2020, took lead in

the lending ecosystem and

almost fifty-five per cent to

thirty per cent of loans

found disbursal through

digital platforms.

Integration of

new-age techno-

logies

While banks have been

increasingly adopting innovative approaches in digital

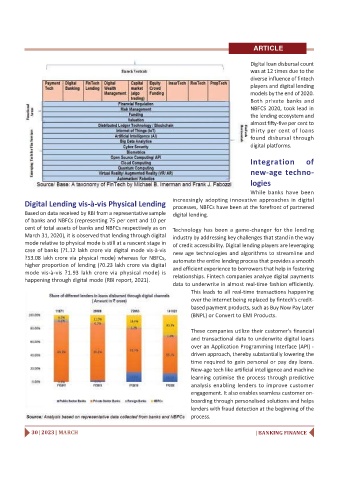

Digital Lending vis-à-vis Physical Lending

processes, NBFCs have been at the forefront of partnered

Based on data received by RBI from a representative sample

digital lending.

of banks and NBFCs (representing 75 per cent and 10 per

cent of total assets of banks and NBFCs respectively as on

Technology has been a game-changer for the lending

March 31, 2020), it is observed that lending through digital

industry by addressing key challenges that stand in the way

mode relative to physical mode is still at a nascent stage in

of credit accessibility. Digital lending players are leveraging

case of banks (?1.12 lakh crore via digital mode vis-à-vis

new age technologies and algorithms to streamline and

?53.08 lakh crore via physical mode) whereas for NBFCs,

automate the entire lending process that provides a smooth

higher proportion of lending (?0.23 lakh crore via digital

and efficient experience to borrowers that help in fostering

mode vis-à-vis ?1.93 lakh crore via physical mode) is

relationships. Fintech companies analyze digital payments

happening through digital mode (RBI report, 2021).

data to underwrite in almost real-time fashion efficiently.

This leads to all real-time transactions happening

over the internet being replaced by fintech's credit-

based payment products, such as Buy Now Pay Later

(BNPL) or Convert to EMI Products.

These companies utilize their customer's financial

and transactional data to underwrite digital loans

over an Application Programming Interface (API) -

driven approach, thereby substantially lowering the

time required to gain personal or pay day loans.

New-age tech like artificial intelligence and machine

learning optimise the process through predictive

analysis enabling lenders to improve customer

engagement. It also enables seamless customer on-

boarding through personalised solutions and helps

lenders with fraud detection at the beginning of the

process.

30 | 2023 | MARCH | BANKING FINANCE