Page 43 - Banking Finance April 2018

P. 43

ARTICLE

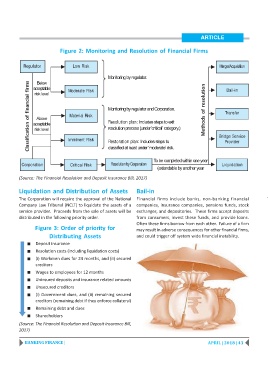

Figure 2: Monitoring and Resolution of Financial Firms

Regulator Low Risk Merger/Acquisition

Monitoring by regulator. Bail-in

Below

Classification of financial firms acceptable Material Risk Monitoring by regulator and Corporation. Methods of resolution Bridge Service

acceptable

Moderate Risk

risk level

Transfer

Above

Resolution plan: Includes steps to exit

resolution process (under’critical’ category.)

risk level

Imminent Risk

Restoration plan: Includes steps to

classified at least under ‘moderate’ risk.

To be completed within one year Provider

Corporation Critical Risk Resolution by Corporation Liquidation

(extendable by another year

(Source: The Financial Resolution and Deposit Insurance Bill, 2017)

Liquidation and Distribution of Assets Bail-in

The Corporation will require the approval of the National Financial firms include banks, non-banking financial

Company Law Tribunal (NCLT) to liquidate the assets of a companies, insurance companies, pensions funds, stock

service provider. Proceeds from the sale of assets will be exchanges, and depositories. These firms accept deposits

distributed in the following priority order. from consumers, invest these funds, and provide loans.

Often these firms borrow from each other. Failure of a firm

Figure 3: Order of priority for may result in adverse consequences for other financial firms,

Distributing Assets and could trigger off system wide financial instability.

Q Deposit insurance

Q Resolution costs (including liquidation costs)

Q (i) Workmen dues for 24 months, and (ii) secured

creditors

Q Wages to employees for 12 months

Q Uninsured deposits and insurance related amounts

Q Unsecured creditors

Q (i) Government dues, and (ii) remaining secured

creditors (remaining debt if they enforce collateral)

Q Remaining debt and dues

Q Sharedholders

(Source: The Financial Resolution and Deposit Insurance Bill,

2017)

BANKING FINANCE | APRIL | 2018 | 43