Page 44 - Banking Finance April 2018

P. 44

ARTICLE

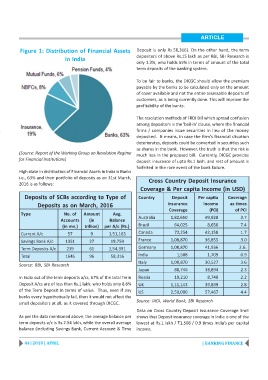

Figure 1: Distribution of Financial Assets Deposit is only Rs.58,316). On the other hand, the term

depositors of above Rs.15 lakh as per RBI, SBI Research is

in India

only 1.3%, who holds 55% in terms of amount of the total

term deposits of the banking system.

To be fair to banks, the DICGC should allow the premium

payable by the banks to be calculated only on the amount

of cover available and not the entire assessable deposits of

customers, as is being currently done. This will improve the

profitability of the banks.

The resolution methods of FRDI Bill which spread confusion

among depositors is the 'bail-in' clause, where the financial

firms / companies issue securities in lieu of the money

deposited. It means, in case the firm's financial situation

deteriorates, deposits could be converted in securities such

as shares in the bank. However, the truth is that the risk is

(Source: Report of the Working Group on Resolution Regime

much less in the proposed bill. Currently, DICGC provides

for Financial Institutions)

deposit insurance of upto Rs.1 lakh. and rest of amount is

forfeited in the rare event of the bank failure.

High stake in distribution of Financial Assets in India is Banks

i.e., 63% and their portfolio of deposits as on 31st March, Cross Country Deposit Insurance

2016 is as follows:

Coverage & Per capita Income (in USD)

Deposits of SCBs according to Type of Country Deposit Per capita Coverage

Deposits as on March, 2016 Insurance Income as times

Coverage (PCI) of PCI

Type No. of Amount Avg.

Australia 1,82,650 49,928 3.7

Accounts (in Balance

(in mn.) trillion) per A/c (Rs.) Brazil 64,025 8,650 7.4

Current A/c 57 9 1,51,163 Canada 72,254 42,158 1.7

Savings Bank A/c 1351 27 19,759 France 1,08,870 36,855 3.0

Term Deposits A/c 239 61 2,54,391 Germany 1,08,870 41,936 2.6.

Total 1646 96 58,316 India 1,508 1,709 0.9

Italy 1,08,870 30,527 3.6

Source: RBI, SBI Research

Japan 88,746 38,894 2.3

In India out of the term deposits a/cs, 67% of the total Term Russia 19,210 8,748 2.2

Deposit A/cs are of less than Rs.1 lakh, who holds only 8.6% UK 1,11,143 39,899 2.8

of the Term Deposit in terms of value. Thus, even if any

US 2,50,000 57,467 4.4

banks every hypothetically fail, then it would not affect the

Source: IADI, World Bank, SBI Research

small depositors at all, as it covered through DICGC.

Data on Cross Country Deposit insurance Coverage limit

As per the data mentioned above, the average balance per shows that Deposit insurance coverage in India is one of the

term deposits a/c is Rs.2.54 lakh, while the overall average lowest at Rs.1 lakh / $1,508 / 0.9 times India's per capital

balance (including Savings Bank, Current Account & Time income.

44 | 2018 | APRIL | BANKING FINANCE