Page 281 - Ebook health insurance IC27

P. 281

Sashi Publications

Another dimension to the usefulness of Reinsurance is the fact that reinsurers

provide technical assistance for pricing and underwriting complex risks, especially

in nascent markets or de-tariffed markets, where old pricing structure is no longer

valid. The final and most important dimension of Reinsurance is linked to the fact,

that in many markets, the use ofreinsurance helps an insurancecompany to optimize

the capital it has to hold solvency purposes. This works as follows :

(i) Reinsurance means the transfer of risk fully or partially to the reinsurer.

(ii) ForanInsurer, theamount ofcapital to bemaintainedis linked to theamount of

business that it has written. So when business is reinsured, the insurer has the

recourseto areinsurerforclaimpayments. Thatmeans, intheory, theinsurance

company does not need to hold capital to the extent of reinsured business. In

practice, marketregulations limittheextenttowhich an insurancecompanycan

take this capital credit. For e.g, in India , for Health Insurance, the prevailing

regulations allow an insurer to get partial credit for reinsured business.

(iii) The capital credit argument is important as the shareholders of the insurance

company always want to reduce the amount of capital used, to maximize

the returns.

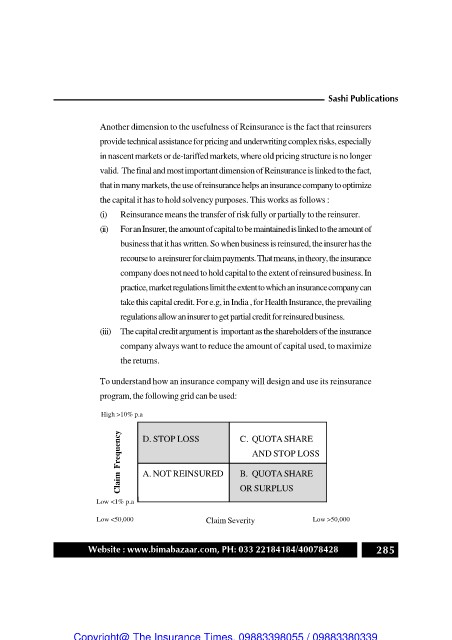

To understand how an insurance company will design and use its reinsurance

program, the following grid can be used:

High >10% p.a

Claim Frequency D. STOP LOSS C. QUOTA SHARE

AND STOP LOSS

A. NOT REINSURED B. QUOTA SHARE

OR SURPLUS

Low <1% p.a

Low <50,000 Claim Severity Low >50,000

Website : www.bimabazaar.com, PH: 033 22184184/40078428 285