Page 567 - Insurance Statistics 2021

P. 567

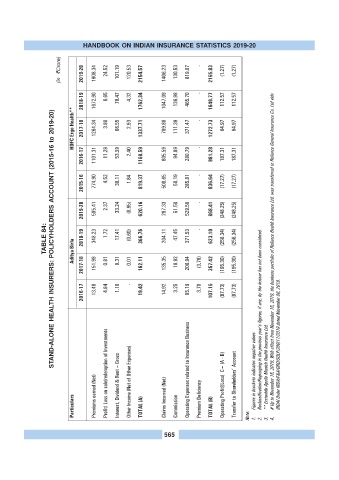

HANDBOOK ON INDIAN INSURANCE STATISTICS 2019-20

(in ?Crore) 2019-20 1908.34 24.52 101.19 120.53 2154.57 1406.23 130.53 619.07 - 2155.83 (1.27) (1.27)

2018-19 1672.90 6.65 78.47 4.32 1762.34 1047.09 136.98 465.70 - 1649.77 112.57 112.57

HDFC Ergo Health** 2017-18 1264.34 3.88 66.55 2.93 1337.71 789.88 111.39 371.47 - 1272.73 64.97 64.97

2016-17 1101.31 11.29 53.59 2.40 1168.59 605.59 94.89 280.79 - 981.28 187.31 187.31

2015-16 774.90 4.52 38.11 1.84 819.37 500.65 50.19 285.81 - 836.64 (17.27) (17.27)

2019-20 585.41 2.37 33.24 (0.85) 620.16 287.33 51.50 529.58 - 868.41 (248.25) (248.25)

TABLE 84: STAND-ALONE HEALTH INSURERS: POLICYHOLDERS ACCOUNT (2015-16 to 2019-20) Aditya Birla 2018-19 348.23 1.72 17.41 (0.60) 366.76 204.11 47.45 371.53 - 623.10 (256.34) (256.34) # Up to November 15, 2019. With effect from November 15, 2019, the business portfolio of Reliance Health Insurance Ltd. was transferred to Reliance General Insurance Co. Ltd vide

2017-18 151.98 0.81 9.31 0.01 162.11 135.35 18.92 206.94 (3.78) 357.42 (195.30) (195.30)

2016-17 13.48 4.84 1.10 - 19.42 14.92 3.25 85.19 3.78 107.15 (87.73) (87.73) Reclassification/Regrouping in the previous year's figures, if any, by the insurer has not been considered.

Profit/ Loss on sale/redemption of Investments Interest, Dividend & Rent – Gross Other Income (Net of Other Expenses) Operating Expenses related to Insurance Business Operating Profit/(Loss) C= (A - B) Transfer to Shareholders’ Account Figures in brackets indicates negative values ** Erstwhile Apollo Munich Health Insurance Ltd. IRDAI Order IRDA/F&A/ORD/SOLP/200/11/2019 dated November 06, 2019.

Particulars Premiums earned (Net) TOTAL (A) Claims Incurred (Net) Commission Premium Deficiency TOTAL (B) Note: 1. 2. 3. 4.

565