Page 628 - Insurance Statistics 2021

P. 628

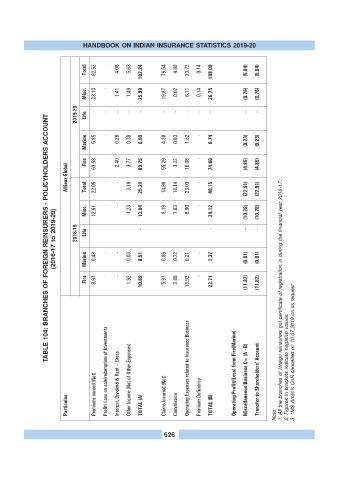

HANDBOOK ON INDIAN INSURANCE STATISTICS 2019-20

Total 92.52 - 4.08 5.63 102.24 79.54 4.68 23.72 0.14 108.08 (5.84) (5.84)

Misc. 23.10 - 1.41 1.49 25.99 19.87 0.62 6.11 0.14 26.75 (0.76) (0.76)

2019-20 Life - - - - - - - - - - - -

TABLE 104: BRANCHES OF FOREIGN REINSURERS - POLICYHOLDERS ACCOUNT

Marine 5.85 - 0.28 0.38 6.50 4.38 0.83 1.52 - 6.74 (0.23) (0.23)

Fire 63.58 - 2.40 3.77 69.75 55.29 3.22 16.08 - 74.60 (4.85) (4.85)

Allianz Global Total 22.05 - - - - 3.18 25.24 14.98 10.14 23.03 - - 48.15 (22.91) (22.91)

(2016-17 to 2019-20) 2018-19 Misc. Life 12.61 0.48 - - 1.23 0.03 13.84 - 0.51 8.19 0.89 7.03 0.22 8.90 0.21 - 24.12 - 1.32 (10.28) - (0.81) (10.28) - (0.81)

Fire Marine 8.97 - - 1.92 10.89 5.91 2.88 13.92 - 22.71 (11.82) (11.82) 1. All the branches of foreign reinsurers got certificate of registration in during the financial year 2016-17.

Profit/ Loss on sale/redemption of Investments Other Income (Net of Other Expenses) Operating Expenses related to Insurance Business Operating Profit/(Loss) from Fire/Marine/ Miscellaneous Business C= (A - B) Transfer to Shareholders’ Account 2. Figures in brackets indicate negative values. 3. *MS Amlin's CoR cancelled on 10.07.2019 on its request

Premiums earned (Net) Interest, Dividend & Rent – Gross Claims Incurred (Net) Premium Deficiency

Particulas TOTAL (A) Commission TOTAL (B) Note:

626