Page 779 - Insurance Statistics 2021

P. 779

Indian Non-life Insurance Industry

Yearbook 2018-19

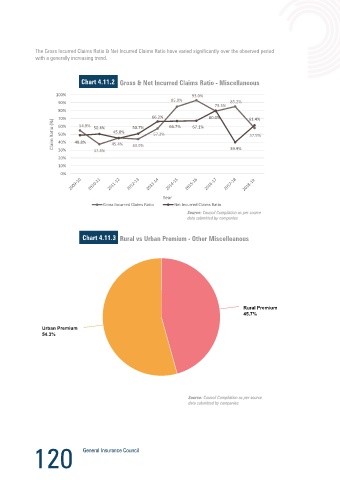

The Gross Incurred Claims Ratio & Net Incurred Claims Ratio have varied significantly over the observed period

with a generally increasing trend. Chart 4.11.4 Channelwise GDPI - Other Miscelleanous

Chart 4.11.2

Chart 4.5.2 Gross & Net Incurred Claims Ratio - Miscellaneous

Others

Others

1.3%

1.3%

100% 93.0%

85.0%

90% 85.2%

Micro Insurance Agent

79.3% Micro Insurance Agent Individual Agents

Individual Agents

0.0%

80% 0.0% 23.5%

23.5%

70% 54.9% 66.2% 80.0% 61.4% Direct Business- Oth…

Claim Ratio (%) 50% 48.8% 50.4% 45.4% 50.7% 57.3% 66.7% 67.1% 57.9% 21.4%

Direct Business- Oth…

60%

21.4%

45.0%

40%

Direct Business- I…

Direct Business- I…

43.9%

30%

0.5%

20% 37.4% 39.9% 0.5%

Arrange…

Referral Arrange…

Referral

10%

0.1%

0.1%

0%

Corporate Agents-B…

Year Corporate Agents-B…

17.6%

Gross Incurred Claims Ratio Net Incurred Claims Ratio 17.6%

Source: Council Compilation as per source

data submitted by companies

Brokers

Brokers

Corporate Agents- Others

33.5% Corporate Agents- Others

33.5%

2.1%

Chart 4.11.3 2.1%

Chart 4.5.2 Rural vs Urban Premium - Other Miscelleanous

Source: Council Compilation as per source

data submitted by companies

A perceptible pattern has been observed between Gross Incurred Claims Ratio and Net Incurred Claims Ratio in respect of

Property (Fire and Engineering), Marine and Aviation and Other Miscellaneous classes of business. The Net Incurred Claims

in these classes are lower than the Gross Incurred Claims showing the efficacy of the Reinsurance Programme of the insurers

for these segments. In respect of Motor and Health segments, the Net Incurred Claims have been higher than the Gross

Incurred Claims reflecting the maximum domestic and net retentions in these segments.

Rural Premium

Rural Premium

45.7%

45.7%

Urban Premium

Urban Premium

54.3%

54.3%

Source: Council Compilation as per source

data submitted by companies

120 121