Page 6 - Nokia Superannuation Booklet

P. 6

06 | Making Possibilities Happen

Insurance

Nokia has tailored an insurance solution within the ANZ Smart Choice fund

which includes Death and Total and Permanent Disability cover.

ANZ Smart Choice product includes:

• Death / Life Insurance - a lump sum paid to your beneficiaries or estate in the event of your death, in addition

to your super balance. Nokia will meet the cost of your default level of Death/Life insurance.

• Total and Permanent Disability (TPD) insurance – a lump sum paid into your super account in the event

you suffer Total and Permanent Disablement. TPD premium cost is deducted from your superannuation balance.

Insurance premiums are deducted monthly in advance and all members have the option to increase cover (subject to

underwriting), reduce cover or opt out of cover at any time by contacting ANZ on 131287.

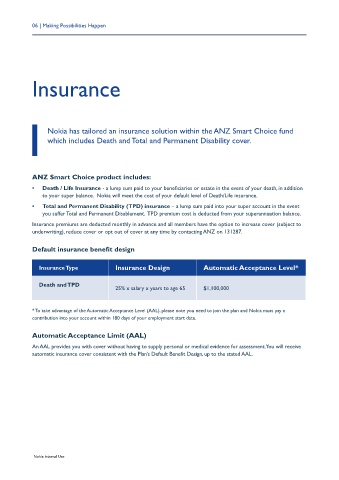

Default insurance benefit design

Insurance Type Insurance Design Automatic Acceptance Level*

Death and TPD

25% x salary x years to age 65 $1,100,000

* To take advantage of the Automatic Acceptance Level (AAL), please note you need to join the plan and Nokia must pay a

contribution into your account within 180 days of your employment start date.

Automatic Acceptance Limit (AAL)

An AAL provides you with cover without having to supply personal or medical evidence for assessment. You will receive

automatic insurance cover consistent with the Plan’s Default Benefit Design, up to the stated AAL.

Nokia Internal Use