Page 26 - Food Outlook

P. 26

PRICES

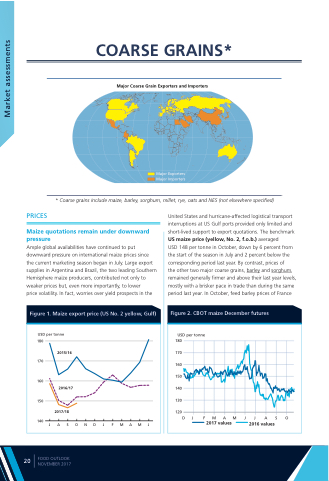

Maize quotations remain under downward pressure

Ample global availabilities have continued to put downward pressure on international maize prices since the current marketing season began in July. Large export supplies in Argentina and Brazil, the two leading Southern Hemisphere maize producers, contributed not only to weaker prices but, even more importantly, to lower

price volatility. In fact, worries over yield prospects in the

Figure 1. Maize export price (US No. 2 yellow, Gulf)

USD per tonne

180

170

160

150

140

United States and hurricane-affected logistical transport interruptions at US Gulf ports provided only limited and short-lived support to export quotations. The benchmark US maize price (yellow, No. 2, f.o.b.) averaged

USD 148 per tonne in October, down by 6 percent from the start of the season in July and 2 percent below the corresponding period last year. By contrast, prices of

the other two major coarse grains, barley and sorghum, remained generally firmer and above their last year levels, mostly with a brisker pace in trade than during the same period last year. In October, feed barley prices of France

Figure 2. CBOT maize December futures

USD per tonne

20

FOOD OUTLOOK NOVEMBER 2017

2015/16

2016/17

2017/18

180

170

160

150

140

130

120

COARSE GRAINS*

Major Coarse Grain Exporters and Importers

Market assessments

Major Exporters Major Importers

* Coarse grains include maize, barley, sorghum, millet, rye, oats and NES (not elsewhere specified)

JASONDJFMAMJ

2017 values

2016 values

DJFMAMJJASO