Page 41 - Food Outlook

P. 41

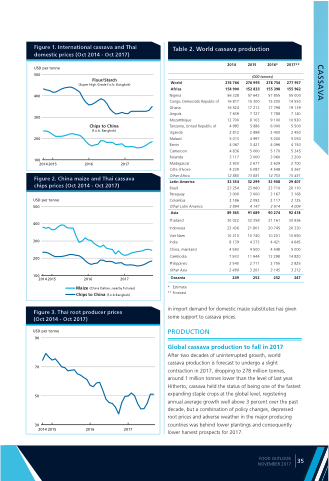

Figure 1. International cassava and Thai domestic prices (Oct 2014 - Oct 2017)

Table 2. World cassava production

USD per tonne 500

400

300

200

100

2014 2015

Flour/Starch

(Super High Grade f.o.b. Bangkok)

Chips to China

(f.o.b. Bangkok)

2016 2017

2014

276 766 154 900 56 328 16 817 16 524 7 639 12 700 4 993 2 812 5 013 4 067 4 836 3 117 2 930 4 239 12 885

32 334

23 254 3 000 2 186 3 894

89 365

30 022

23 436

10 210 8 139 4 593 7 933 2 540 2 490

249

2015 2016*

(000 tonnes)

2017**

277 957 155 962 55 000 14 550 19 139 7 140 10 920 5 500 2 450 5 050 4 150 5 345 3 200 2 700 5 367 15 451

29 407

20 110 3 168 2 125 4 004

92 418

30 936

20 330

10 650 4 645 5 000

14 820 2 825 3 212

247

Figure 2. China maize and Thai cassava chips prices (Oct 2014 - Oct 2017)

World

Africa

Nigeria

Congo, Democratic Republic of Ghana

Angola

Mozambique

Tanzania, United Republic of Uganda

Malawi

Benin

Cameroon

Rwanda

Madagascar

Côte d'Ivoire

Other Africa

Latin America

Brazil

Paraguay

Colombia

Other Latin America

Asia

Thailand

Indonesia

Viet Nam

India

China, mainland Cambodia Philippines Other Asia

Oceania

* Estimate ** Forecast

276 995 152 833 57 643 15 300 17 213 7 727 8 103 5 886 2 898 4 997 3 421 5 000 3 000 2 677 5 087 13 881

32 299

23 060 3 000 2 092 4 147

91 689

32 358

21 801

10 740 4 373 4 500

11 944 2 711 3 261

252

278 754 155 398 57 855 15 200 17 798 7 788 9 100 6 000 2 400 5 000 4 096 5 170 3 060 2 629 4 548 14 753

32 908

23 710 3 167 2 117 3 914

90 274

31 161

20 745

10 201 4 421 4 548

13 298 2 755 3 145

252

USD per tonne 500

400 300 200

100

2014 2015

2016 2017

Maize (China Dalian, nearby futures) Chips to China (f.o.b Bangkok)

Figure 3. Thai root producer prices (Oct 2014 - Oct 2017)

in import demand for domestic maize substitutes has given some support to cassava prices.

PRODUCTION

Global cassava production to fall in 2017

After two decades of uninterrupted growth, world

cassava production is forecast to undergo a slight contraction in 2017, dropping to 278 million tonnes, around 1 million tonnes lower than the level of last year. Hitherto, cassava held the status of being one of the fastest expanding staple crops at the global level, registering annual average growth well above 3 percent over the past decade, but a combination of policy changes, depressed root prices and adverse weather in the major producing countries was behind lower plantings and consequently lower harvest prospects for 2017.

USD per tonne 90

70

50

30

2014 2015

2016 2017

FOOD OUTLOOK NOVEMBER 2017

35

CASSAVA