Page 103 - Demo

P. 103

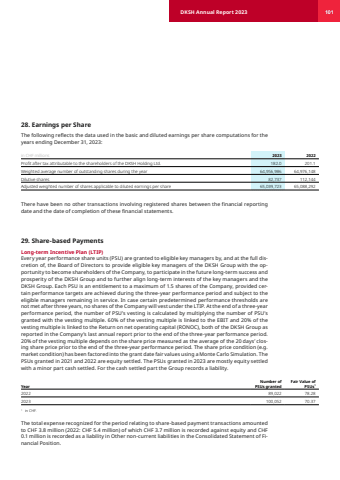

DKSH Annual Report 2023 10128. Earnings per ShareThe following reflects the data used in the basic and diluted earnings per share computations for the years ending December 31, 2023:in CHF millions 2023 2022Profit after tax attributable to the shareholders of the DKSH Holding Ltd. 182.0 201.1 Weighted average number of outstanding shares during the year 64,956,986 64,976,148 Dilutive shares 82,737 112,144 Adjusted weighted number of shares applicable to diluted earnings per share 65,039,723 65,088,292 There have been no other transactions involving registered shares between the financial reporting date and the date of completion of these financial statements. 29. Share-based PaymentsLong-term Incentive Plan (LTIP)Every year performance share units (PSU) are granted to eligible key managers by, and at the full dis,cretion of, the Board of Directors to provide eligible key managers of the DKSH Group with the opportunity to become shareholders of the Company, to participate in the future long-term success and prosperity of the DKSH Group and to further align long-term interests of the key managers and the DKSH Group. Each PSU is an entitlement to a maximum of 1.5 shares of the Company, provided certain performance targets are achieved during the three-year performance period and subject to the eligible managers remaining in service. In case certain predetermined performance thresholds are not met after three years, no shares of the Company will vest under the LTIP. At the end of a three-year performance period, the number of PSU%u2019s vesting is calculated by multiplying the number of PSU%u2019s granted with the vesting multiple. 60% of the vesting multiple is linked to the EBIT and 20% of the vesting multiple is linked to the Return on net operating capital (RONOC), both of the DKSH Group as reported in the Company%u2019s last annual report prior to the end of the three-year performance period. 20% of the vesting multiple depends on the share price measured as the average of the 20 days%u2019 closing share price prior to the end of the three-year performance period. The share price condition (e.g. market condition) has been factored into the grant date fair values using a Monte Carlo Simulation. The PSUs granted in 2021 and 2022 are equity settled. The PSUs granted in 2023 are mostly equity settled with a minor part cash settled. For the cash settled part the Group records a liability.YearNumber of PSUs grantedFair Value of PSUs12022 89,022 78.282023 100,052 70.371 in CHF.The total expense recognized for the period relating to share-based payment transactions amounted to CHF 3.8 million (2022: CHF 5.4 million) of which CHF 3.7 million is recorded against equity and CHF 0.1 million is recorded as a liability in Other non-current liabilities in the Consolidated Statement of Financial Position.