Page 100 - Demo

P. 100

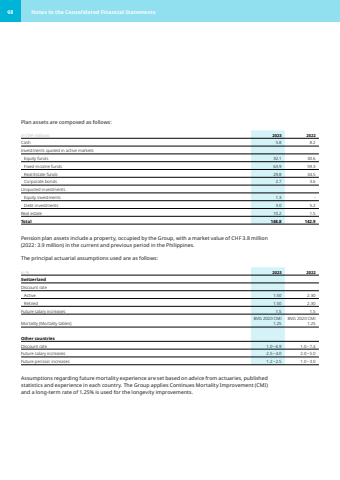

Plan assets are composed as follows:in CHF millions 2023 2022Cash 5.8 8.2Investments quoted in active marketsEquity funds 32.1 30.6 Fixed-income funds 63.9 59.3 Real Estate funds 29.8 34.5 Corporate bonds 2.7 3.6 Unquoted investmentsEquity investments 1.3 - Debt investments 3.0 5.2 Real estate 10.2 1.5 Total 148.8 142.9 Pension plan assets include a property, occupied by the Group, with a market value of CHF 3.8 million (2022: 3.9 million) in the current and previous period in the Philippines.The principal actuarial assumptions used are as follows:in % 2023 2022SwitzerlandDiscount rateActive 1.50 2.30Retired 1.50 2.30Future salary increases 1.5 1.5 Mortality (Mortality tables) BVG 2020 CMI 1.25 BVG 2020 CMI 1.25 Other countriesDiscount rate 1.0%u20136.9 1.0%u20137.4 Future salary increases 2.5%u20134.0 2.0%u20135.0 Future pension increases 1.2%u20132.5 1.0%u20133.0 Assumptions regarding future mortality experience are set based on advice from actuaries, published statistics and experience in each country. The Group applies Continues Mortality Improvement (CMI) and a long-term rate of 1.25% is used for the longevity improvements.98 Notes to the Consolidated Financial Statements