Page 99 - Demo

P. 99

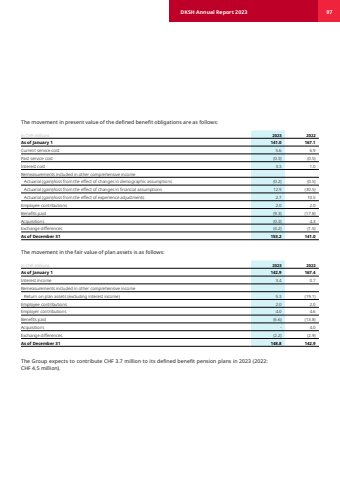

DKSH Annual Report 2023 97The movement in present value of the defined benefit obligations are as follows:in CHF millions 2023 2022As of January 1 141.0 167.1 Current service cost 5.6 6.9 Past service cost (0.3) (0.5) Interest cost 3.3 1.0 Remeasurements included in other comprehensive incomeActuarial (gain)/loss from the effect of changes in demographic assumptions (0.2) (0.5) Actuarial (gain)/loss from the effect of changes in financial assumptions 12.9 (30.5) Actuarial (gain)/loss from the effect of experience adjustments 2.7 10.5 Employee contributions 2.0 2.0 Benefits paid (9.3) (17.8) Acquisitions (0.3) 4.3 Exchange differences (4.2) (1.5) As of December 31 153.2 141.0 The movement in the fair value of plan assets is as follows:in CHF millions 2023 2022As of January 1 142.9 167.4 Interest income 3.4 0.7 Remeasurements included in other comprehensive incomeReturn on plan assets (excluding interest income) 5.3 (19.1) Employee contributions 2.0 2.0 Employer contributions 4.0 4.6 Benefits paid (6.6) (13.8) Acquisitions - 4.0 Exchange differences (2.2) (2.9) As of December 31 148.8 142.9 The Group expects to contribute CHF 3.7 million to its defined benefit pension plans in 2023 (2022: CHF 4.5 million).