Page 104 - Demo

P. 104

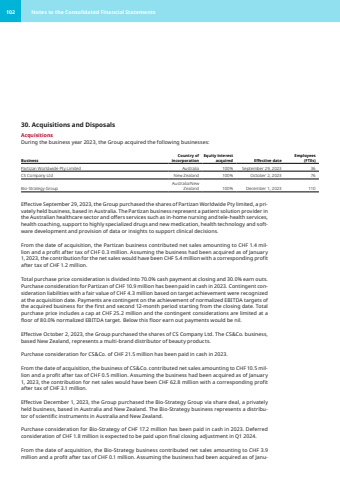

102 Notes to the Consolidated Financial Statements 30. Acquisitions and DisposalsAcquisitionsDuring the business year 2023, the Group acquired the following businesses:BusinessCountry of incorporationEquity interest acquired Effective dateEmployees (FTEs)Partizan Worldwide Pty Limited Australia 100% September 29, 2023 36 CS Company Ltd New Zealand 100% October 2, 2023 76 Bio-Strategy GroupAustralia/New Zealand 100% December 1, 2023 110 Effective September 29, 2023, the Group purchased the shares of Partizan Worldwide Pty limited, a pri,vately held business, based in Australia. The Partizan business represent a patient solution provider in the Australian healthcare sector and offers services such as in-home nursing and tele-health services, health coaching, support to highly specialized drugs and new medication, health technology and software development and provision of data or insights to support clinical decisions.From the date of acquisition, the Partizan business contributed net sales amounting to CHF 1.4 million and a profit after tax of CHF 0.3 million. Assuming the business had been acquired as of January 1, 2023, the contribution for the net sales would have been CHF 5.4 million with a corresponding profit after tax of CHF 1.2 million.Total purchase price consideration is divided into 70.0% cash payment at closing and 30.0% earn outs. Purchase consideration for Partizan of CHF 10.9 million has been paid in cash in 2023. Contingent con,sideration liabilities with a fair value of CHF 4.3 million based on target achievement were recognized at the acquisition date. Payments are contingent on the achievement of normalized EBITDA targets of the acquired business for the first and second 12-month period starting from the closing date. Total purchase price includes a cap at CHF 25.2 million and the contingent considerations are limited at a floor of 80.0% normalized EBITDA target. Below this floor earn out payments would be nil.Effective October 2, 2023, the Group purchased the shares of CS Company Ltd. The CS&Co. business, based New Zealand, represents a multi-brand distributor of beauty products.Purchase consideration for CS&Co. of CHF 21.5 million has been paid in cash in 2023.From the date of acquisition, the business of CS&Co. contributed net sales amounting to CHF 10.5 million and a profit after tax of CHF 0.5 million. Assuming the business had been acquired as of January 1, 2023, the contribution for net sales would have been CHF 62.8 million with a corresponding profit after tax of CHF 3.1 million.Effective December 1, 2023, the Group purchased the Bio-Strategy Group via share deal, a privately held business, based in Australia and New Zealand. The Bio-Strategy business represents a distributor of scientific instruments in Australia and New Zealand.Purchase consideration for Bio-Strategy of CHF 17.2 million has been paid in cash in 2023. Deferred consideration of CHF 1.8 million is expected to be paid upon final closing adjustment in Q1 2024. From the date of acquisition, the Bio-Strategy business contributed net sales amounting to CHF 3.9 million and a profit after tax of CHF 0.1 million. Assuming the business had been acquired as of Janu-