Page 108 - Demo

P. 108

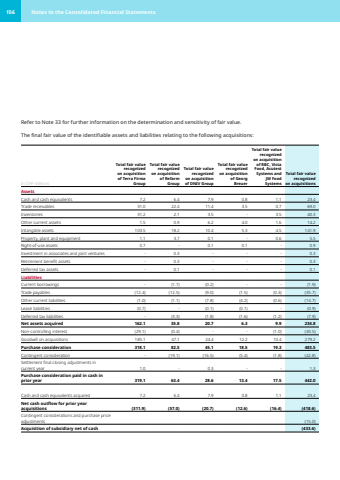

Refer to Note 33 for further information on the determination and sensitivity of fair value.The final fair value of the identifiable assets and liabilities relating to the following acquisitions:in CHF millionsTotal fair value recognizedon acquisition of Terra Firma GroupTotal fair value recognizedon acquisition of Refarm GroupTotal fair value recognizedon acquisition of DNIV GroupTotal fair value recognizedon acquisition of Georg Breuer Total fair value recognizedon acquisition of RBC, Victa Food, Acutest Systems and JW Food SystemsTotal fair value recognizedon acquisitionsAssetsCash and cash equivalents 7.2 6.4 7.9 0.8 1.1 23.4 Trade receivables 31.0 22.4 11.4 3.5 0.7 69.0 Inventories 31.2 2.1 3.5 - 3.5 40.3 Other current assets 1.5 0.9 6.2 4.0 1.6 14.2 Intangible assets 103.5 18.2 10.4 5.3 4.5 141.9 Property, plant and equipment 1.1 3.7 0.1 - 0.6 5.5 Right-of-use assets 0.7 - 0.1 0.1 - 0.9 Investment in associates and joint ventures - 0.3 - - - 0.3 Retirement benefit assets - 0.3 - - - 0.3 Deferred tax assets - 0.1 - - - 0.1 LiabilitiesCurrent borrowings - (1.7) (0.2) - - (1.9) Trade payables (12.4) (12.5) (9.0) (1.5) (0.3) (35.7) Other current liabilities (1.0) (1.1) (7.8) (4.2) (0.6) (14.7) Lease liabilities (0.7) - (0.1) (0.1) - (0.9) Deferred tax liabilities - (3.3) (1.8) (1.6) (1.2) (7.9) Net assets acquired 162.1 35.8 20.7 6.3 9.9 234.8 Non-controlling interest (29.1) (0.4) - - (1.0) (30.5) Goodwill on acquisitions 185.1 47.1 24.4 12.2 10.4 279.2 Purchase consideration 318.1 82.5 45.1 18.5 19.3 483.5 Contingent consideration - (19.1) (16.5) (5.4) (1.8) (42.8) Settlement final closing adjustments in current year 1.0 - 0.3 - - 1.3 Purchase consideration paid in cash in prior year 319.1 63.4 28.6 13.4 17.5 442.0 Cash and cash equivalents acquired 7.2 6.4 7.9 0.8 1.1 23.4 Net cash outflow for prior year acquisitions (311.9) (57.0) (20.7) (12.6) (16.4) (418.6) Contingent considerations and purchase price adjustments (15.0) Acquisition of subsidiary net of cash (433.6) 106 Notes to the Consolidated Financial Statements