Page 111 - Demo

P. 111

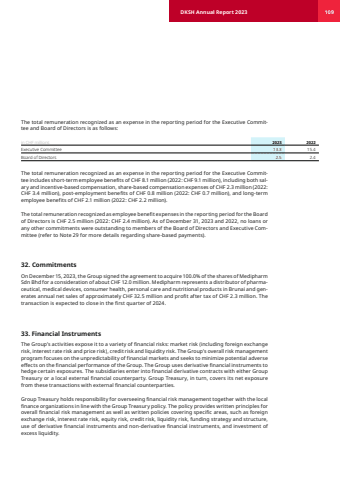

DKSH Annual Report 2023 109The total remuneration recognized as an expense in the reporting period for the Executive Committee and Board of Directors is as follows:in CHF millions 2023 2022Executive Committee 13.3 15.4 Board of Directors 2.5 2.4 The total remuneration recognized as an expense in the reporting period for the Executive Committee includes short-term employee benefits of CHF 8.1 million (2022: CHF 9.1 million), including both salary and incentive-based compensation, share-based compensation expenses of CHF 2.3 million (2022: CHF 3.4 million), post-employment benefits of CHF 0.8 million (2022: CHF 0.7 million), and long-term employee benefits of CHF 2.1 million (2022: CHF 2.2 million).The total remuneration recognized as employee benefit expenses in the reporting period for the Board of Directors is CHF 2.5 million (2022: CHF 2.4 million). As of December 31, 2023 and 2022, no loans or any other commitments were outstanding to members of the Board of Directors and Executive Committee (refer to Note 29 for more details regarding share-based payments).32. CommitmentsOn December 15, 2023, the Group signed the agreement to acquire 100.0% of the shares of Medipharm Sdn Bhd for a consideration of about CHF 12.0 million. Medipharm represents a distributor of pharmaceutical, medical devices, consumer health, personal care and nutritional products in Brunai and generates annual net sales of approximately CHF 32.5 million and profit after tax of CHF 2.3 million. The transaction is expected to close in the first quarter of 2024. 33. Financial InstrumentsThe Group%u2019s activities expose it to a variety of financial risks: market risk (including foreign exchange risk, interest rate risk and price risk), credit risk and liquidity risk. The Group%u2019s overall risk management program focuses on the unpredictability of financial markets and seeks to minimize potential adverse effects on the financial performance of the Group. The Group uses derivative financial instruments to hedge certain exposures. The subsidiaries enter into financial derivative contracts with either Group Treasury or a local external financial counterparty. Group Treasury, in turn, covers its net exposure from these transactions with external financial counterparties.Group Treasury holds responsibility for overseeing financial risk management together with the local finance organizations in line with the Group Treasury policy. The policy provides written principles for overall financial risk management as well as written policies covering specific areas, such as foreign exchange risk, interest rate risk, equity risk, credit risk, liquidity risk, funding strategy and structure, use of derivative financial instruments and non-derivative financial instruments, and investment of excess liquidity.