Page 114 - Demo

P. 114

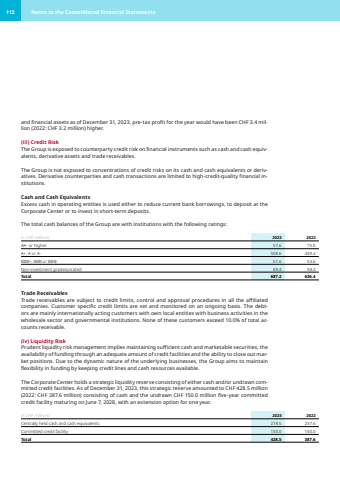

and financial assets as of December 31, 2023, pre-tax profit for the year would have been CHF 3.4 mil,lion (2022: CHF 3.2 million) higher.(iii) Credit RiskThe Group is exposed to counterparty credit risk on financial instruments such as cash and cash equiv,alents, derivative assets and trade receivables.The Group is not exposed to concentrations of credit risks on its cash and cash equivalents or derivatives. Derivative counterparties and cash transactions are limited to high-credit-quality financial institutions.Cash and Cash EquivalentsExcess cash in operating entities is used either to reduce current bank borrowings, to deposit at the Corporate Center or to invest in short-term deposits.The total cash balances of the Group are with institutions with the following ratings:in CHF millions 2023 2022AA- or higher 57.6 75.0 A+, A or A- 508.6 449.4 BBB+, BBB or BBB- 51.6 53.6 Non-investment grade/unrated 69.4 58.4 Total 687.2 636.4 Trade ReceivablesTrade receivables are subject to credit limits, control and approval procedures in all the affiliated companies. Customer specific credit limits are set and monitored on an ongoing basis. The debtors are mainly internationally acting customers with own local entities with business activities in the wholesale sector and governmental institutions. None of these customers exceed 10.0% of total accounts receivable.(iv) Liquidity RiskPrudent liquidity risk management implies maintaining sufficient cash and marketable securities, the availability of funding through an adequate amount of credit facilities and the ability to close out market positions. Due to the dynamic nature of the underlying businesses, the Group aims to maintain flexibility in funding by keeping credit lines and cash resources available.The Corporate Center holds a strategic liquidity reserve consisting of either cash and/or undrawn com,mitted credit facilities. As of December 31, 2023, this strategic reserve amounted to CHF 428.5 million (2022: CHF 387.6 million) consisting of cash and the undrawn CHF 150.0 million five-year committed credit facility maturing on June 7, 2028, with an extension option for one year. in CHF millions 2023 2022Centrally held cash and cash equivalents 278.5 237.6 Committed credit facility 150.0 150.0 Total 428.5 387.6 112 Notes to the Consolidated Financial Statements