Page 117 - Demo

P. 117

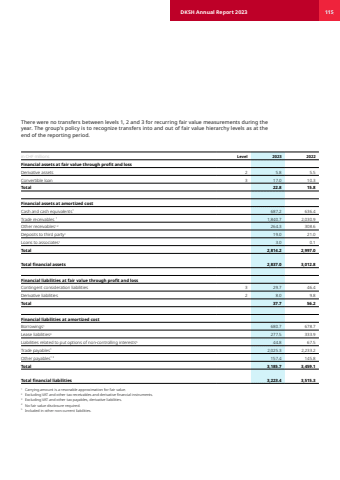

There were no transfers between levels 1, 2 and 3 for recurring fair value measurements during the year. The group%u2019s policy is to recognize transfers into and out of fair value hierarchy levels as at the end of the reporting period.in CHF millions Level 2023 2022Financial assets at fair value through profit and lossDerivative assets 2 5.8 5.5 Convertible loan 3 17.0 10.3 Total 22.8 15.8 Financial assets at amortized costCash and cash equivalents1 687.2 636.4 Trade receivables 1 1,840.7 2,030.9 Other receivables1 2 264.3 308.6 Deposits to third party1 19.0 21.0 Loans to associates1 3.0 0.1 Total 2,814.2 2,997.0 Total financial assets 2,837.0 3,012.8 Financial liabilities at fair value through profit and lossContingent consideration liabilities 3 29.7 46.4 Derivative liabilities 2 8.0 9.8 Total 37.7 56.2 Financial liabilities at amortized costBorrowings1 680.7 678.7 Lease liabilities4 277.5 333.9 Liabilities related to put options of non-controlling interests5 44.8 67.5 Trade payables1 2,025.3 2,233.2 Other payables1 3 157.4 145.8 Total 3,185.7 3,459.1 Total financial liabilities 3,223.4 3,515.3 1 Carrying amount is a resonable approximation for fair value.2 Excluding VAT and other tax receivables and derivative financial instruments.3 Excluding VAT and other tax payables, derivative liabilities.4 No fair value disclosure required.5 Included in other non-current liabilities.DKSH Annual Report 2023 115