Page 119 - Demo

P. 119

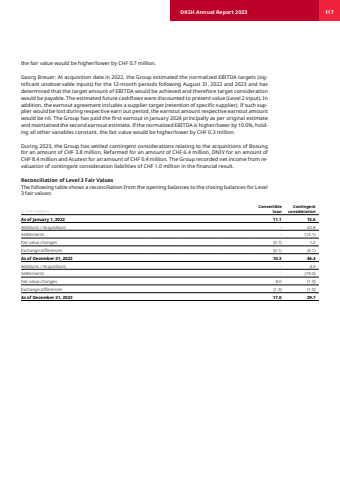

the fair value would be higher/lower by CHF 0.7 million.Georg Breuer: At acquisition date in 2022, the Group estimated the normalized EBITDA targets (significant unobservable inputs) for the 12-month periods following August 31, 2022 and 2023 and has determined that the target amount of EBITDA would be achieved and therefore target consideration would be payable. The estimated future cashflows were discounted to present value (Level 2 input). In addition, the earnout agreement includes a supplier target (retention of specific supplier). If such supplier would be lost during respective earn out period, the earnout amount respective earnout amount would be nil. The Group has paid the first earnout in January 2024 principally as per original estimate and maintained the second earnout estimate. If the normalized EBITDA is higher/lower by 10.0%, holding all other variables constant, the fair value would be higher/lower by CHF 0.3 million.During 2023, the Group has settled contingent considerations relating to the acquisitions of Bosung for an amount of CHF 3.8 million, Refarmed for an amount of CHF 6.4 million, DNIV for an amount of CHF 8.4 million and Acutest for an amount of CHF 0.4 million. The Group recorded net income from revaluation of contingent consideration liabilities of CHF 1.0 million in the financial result.Reconciliation of Level 3 Fair Values The following table shows a reconciliation from the opening balances to the closing balances for Level 3 fair values:in CHF millionsConvertible loan Contingent considerationAs of January 1, 2022 11.1 15.6 Additions / Acquisitions - 42.8 Settlements - (13.1) Fair value changes (0.7) 1.2 Exchange differences (0.1) (0.1) As of December 31, 2022 10.3 46.4 Additions / Acquisitions - 4.3 Settlements - (19.0) Fair value changes 8.0 (1.0) Exchange differences (1.3) (1.0) As of December 31, 2023 17.0 29.7 DKSH Annual Report 2023 117