Page 115 - Demo

P. 115

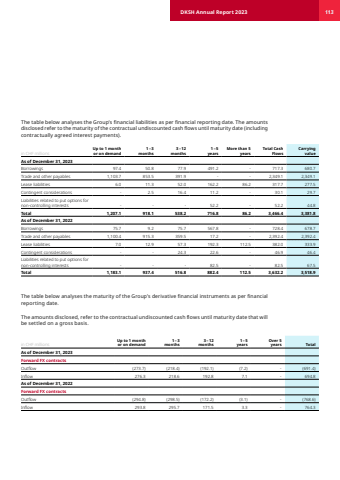

The table below analyses the Group%u2019s financial liabilities as per financial reporting date. The amounts disclosed refer to the maturity of the contractual undiscounted cash flows until maturity date (including contractually agreed interest payments).in CHF millionsUp to 1 month or on demand1%u20133months3%u201312months1%u20135yearsMore than 5 yearsTotal Cash Flows Carrying value As of December 31, 2023Borrowings 97.4 50.8 77.9 491.2 - 717.3 680.7 Trade and other payables 1,103.7 853.5 391.9 - - 2,349.1 2,349.1 Lease liabilities 6.0 11.3 52.0 162.2 86.2 317.7 277.5 Contingent considerations - 2.5 16.4 11.2 - 30.1 29.7 Liabilities related to put options for non-controlling interests - - - 52.2 - 52.2 44.8 Total 1,207.1 918.1 538.2 716.8 86.2 3,466.4 3,381.8 As of December 31, 2022Borrowings 75.7 9.2 75.7 567.8 - 728.4 678.7 Trade and other payables 1,100.4 915.3 359.5 17.2 - 2,392.4 2,392.4 Lease liabilities 7.0 12.9 57.3 192.3 112.5 382.0 333.9 Contingent considerations - - 24.3 22.6 - 46.9 46.4 Liabilities related to put options for non-controlling interests - - - 82.5 - 82.5 67.5 Total 1,183.1 937.4 516.8 882.4 112.5 3,632.2 3,518.9 The table below analyses the maturity of the Group%u2019s derivative financial instruments as per financial reporting date.The amounts disclosed, refer to the contractual undiscounted cash flows until maturity date that will be settled on a gross basis.in CHF millionsUp to 1 month or on demand1%u20133months3%u201312months1%u20135yearsOver 5 years Total As of December 31, 2023Forward FX contractsOutflow (273.7) (218.4) (192.1) (7.2) - (691.4) Inflow 276.3 218.6 192.8 7.1 - 694.8 As of December 31, 2022Forward FX contractsOutflow (294.8) (298.5) (172.2) (3.1) - (768.6) Inflow 293.8 295.7 171.5 3.3 - 764.3 DKSH Annual Report 2023 113