Page 112 - Demo

P. 112

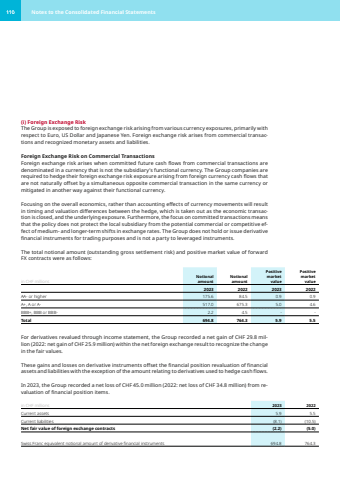

(i) Foreign Exchange RiskThe Group is exposed to foreign exchange risk arising from various currency exposures, primarily with respect to Euro, US Dollar and Japanese Yen. Foreign exchange risk arises from commercial transactions and recognized monetary assets and liabilities.Foreign Exchange Risk on Commercial TransactionsForeign exchange risk arises when committed future cash flows from commercial transactions are denominated in a currency that is not the subsidiary%u2019s functional currency. The Group companies are required to hedge their foreign exchange risk exposure arising from foreign currency cash flows that are not naturally offset by a simultaneous opposite commercial transaction in the same currency or mitigated in another way against their functional currency.Focusing on the overall economics, rather than accounting effects of currency movements will result in timing and valuation differences between the hedge, which is taken out as the economic transaction is closed, and the underlying exposure. Furthermore, the focus on committed transactions means that the policy does not protect the local subsidiary from the potential commercial or competitive ef,fect of medium- and longer-term shifts in exchange rates. The Group does not hold or issue derivative financial instruments for trading purposes and is not a party to leveraged instruments.The total notional amount (outstanding gross settlement risk) and positive market value of forward FX contracts were as follows:in CHF millionsNotional amountNotional amountPositive market valuePositive market value2023 2022 2023 2022AA- or higher 175.6 84.5 0.9 0.9 A+, A or A- 517.0 675.3 5.0 4.6 BBB+, BBB or BBB- 2.2 4.5 - -Total 694.8 764.3 5.9 5.5 For derivatives revalued through income statement, the Group recorded a net gain of CHF 29.8 million (2022: net gain of CHF 25.9 million) within the net foreign exchange result to recognize the change in the fair values.These gains and losses on derivative instruments offset the financial position revaluation of financial assets and liabilities with the exception of the amount relating to derivatives used to hedge cash flows. In 2023, the Group recorded a net loss of CHF 45.0 million (2022: net loss of CHF 34.8 million) from revaluation of financial position items.in CHF millions 2023 2022Current assets 5.9 5.5 Current liabilities (8.1) (10.5) Net fair value of foreign exchange contracts (2.2) (5.0) Swiss Franc equivalent notional amount of derivative financial instruments 694.8 764.3 110 Notes to the Consolidated Financial Statements