Page 120 - Demo

P. 120

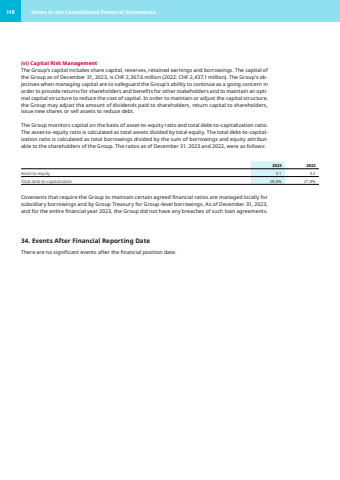

(vi) Capital Risk ManagementThe Group%u2019s capital includes share capital, reserves, retained earnings and borrowings. The capital of the Group as of December 31, 2023, is CHF 2,367.6 million (2022: CHF 2,437.1 million). The Group%u2019s ob,jectives when managing capital are to safeguard the Group%u2019s ability to continue as a going concern in order to provide returns for shareholders and benefits for other stakeholders and to maintain an opti,mal capital structure to reduce the cost of capital. In order to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to shareholders, return capital to shareholders, issue new shares or sell assets to reduce debt.The Group monitors capital on the basis of asset-to-equity ratio and total debt-to-capitalization ratio. The asset-to-equity ratio is calculated as total assets divided by total equity. The total debt-to-capitalization ratio is calculated as total borrowings divided by the sum of borrowings and equity attributable to the shareholders of the Group. The ratios as of December 31, 2023 and 2022, were as follows:2023 2022Asset-to-equity 3.1 3.2 Total debt-to-capitalization 28.8% 27.8%Covenants that require the Group to maintain certain agreed financial ratios are managed locally for subsidiary borrowings and by Group Treasury for Group-level borrowings. As of December 31, 2023, and for the entire financial year 2023, the Group did not have any breaches of such loan agreements.34. Events After Financial Reporting DateThere are no significant events after the financial position date.118 Notes to the Consolidated Financial Statements