Page 16 - Franklin Madison 2022 Benefits Guide

P. 16

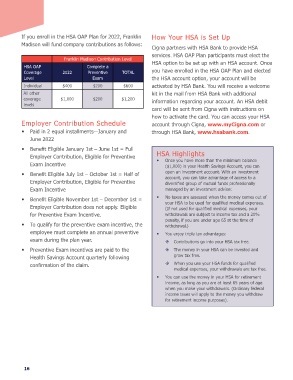

If you enroll in the HSA OAP Plan for 2022, Franklin How Your HSA is Set Up

Madison will fund company contributions as follows: Cigna partners with HSA Bank to provide HSA

Franklin Madison Contribution Level services. HSA OAP Plan participants must elect the

HSA OAP Complete a HSA option to be set up with an HSA account. Once

Coverage 2022 Preventive TOTAL you have enrolled in the HSA OAP Plan and elected

Level Exam the HSA account option, your account will be

Individual $400 $200 $600 activated by HSA Bank. You will receive a welcome

All other kit in the mail from HSA Bank with additional

coverage $1,000 $200 $1,200 information regarding your account. An HSA debit

levels

card will be sent from Cigna with instructions on

how to activate the card. You can access your HSA

Employer Contribution Schedule account through Cigna, www.myCigna.com or

y Paid in 2 equal installments—January and through HSA Bank, www.hsabank.com.

June 2022

y Beneit Eligible January 1st – June 1st = Full

Employer Contribution, Eligible for Preventive HSA Highlights

Once you have more than the minimum balance

Exam Incentive y ($1,000) in your Health Savings Account, you can

y Beneit Eligible July 1st – October 1st = Half of open an investment account. With an investment

account, you can take advantage of access to a

Employer Contribution, Eligible for Preventive diversiied group of mutual funds professionally

Exam Incentive managed by an investment adviser.

y Beneit Eligible November 1st – December 1st = y No taxes are assessed when the money comes out of

your HSA to be used for qualiied medical expenses.

Employer Contribution does not apply. Eligible (If not used for qualiied medical expenses, your

for Preventive Exam Incentive. withdrawals are subject to income tax and a 20%

y To qualify for the preventive exam incentive, the penalty, if you are under age 65 at the time of

withdrawal.)

employee must complete an annual preventive y You enjoy triple tax advantages:

exam during the plan year. Contributions go into your HSA tax free.

y Preventive Exam incentives are paid to the The money in your HSA can be invested and

Health Savings Account quarterly following grow tax free.

conirmation of the claim. When you use your HSA funds for qualiied

medical expenses, your withdrawals are tax free.

y You can use the money in your HSA for retirement

income, as long as you are at least 65 years of age

when you make your withdrawals. (Ordinary federal

income taxes will apply to the money you withdraw

for retirement income purposes).

16

Madison will fund company contributions as follows: Cigna partners with HSA Bank to provide HSA

Franklin Madison Contribution Level services. HSA OAP Plan participants must elect the

HSA OAP Complete a HSA option to be set up with an HSA account. Once

Coverage 2022 Preventive TOTAL you have enrolled in the HSA OAP Plan and elected

Level Exam the HSA account option, your account will be

Individual $400 $200 $600 activated by HSA Bank. You will receive a welcome

All other kit in the mail from HSA Bank with additional

coverage $1,000 $200 $1,200 information regarding your account. An HSA debit

levels

card will be sent from Cigna with instructions on

how to activate the card. You can access your HSA

Employer Contribution Schedule account through Cigna, www.myCigna.com or

y Paid in 2 equal installments—January and through HSA Bank, www.hsabank.com.

June 2022

y Beneit Eligible January 1st – June 1st = Full

Employer Contribution, Eligible for Preventive HSA Highlights

Once you have more than the minimum balance

Exam Incentive y ($1,000) in your Health Savings Account, you can

y Beneit Eligible July 1st – October 1st = Half of open an investment account. With an investment

account, you can take advantage of access to a

Employer Contribution, Eligible for Preventive diversiied group of mutual funds professionally

Exam Incentive managed by an investment adviser.

y Beneit Eligible November 1st – December 1st = y No taxes are assessed when the money comes out of

your HSA to be used for qualiied medical expenses.

Employer Contribution does not apply. Eligible (If not used for qualiied medical expenses, your

for Preventive Exam Incentive. withdrawals are subject to income tax and a 20%

y To qualify for the preventive exam incentive, the penalty, if you are under age 65 at the time of

withdrawal.)

employee must complete an annual preventive y You enjoy triple tax advantages:

exam during the plan year. Contributions go into your HSA tax free.

y Preventive Exam incentives are paid to the The money in your HSA can be invested and

Health Savings Account quarterly following grow tax free.

conirmation of the claim. When you use your HSA funds for qualiied

medical expenses, your withdrawals are tax free.

y You can use the money in your HSA for retirement

income, as long as you are at least 65 years of age

when you make your withdrawals. (Ordinary federal

income taxes will apply to the money you withdraw

for retirement income purposes).

16